The Government Shutdown: What It Means for Your Taxes & Student Loans

It’s been all over the news. We are currently in the midst of a government shutdown. Now that sounds bad, what does it really mean? And more importantly, what does it mean for taxpaying Americans and student loan borrowers? Let’s dig into it.

What is a Government Shutdown?

A government shutdown is pretty much what it sounds like; during a shutdown, nonessential offices of the government are closed. Government shutdowns occur when there is no approval on the upcoming year’s federal budget. If no agreement is reached on the budget, many operations that are federally run will close down (like national parks and museums).

Any nonessential federal employees will be put on unpaid leave (or “furloughed”). Essential federal employees may have to work without pay. Certain organizations may stay open by running on their cash reserves but only as long as those reserves last. Until a compromise is reached, the shutdown will persist.

What’s up with the current government shutdown?

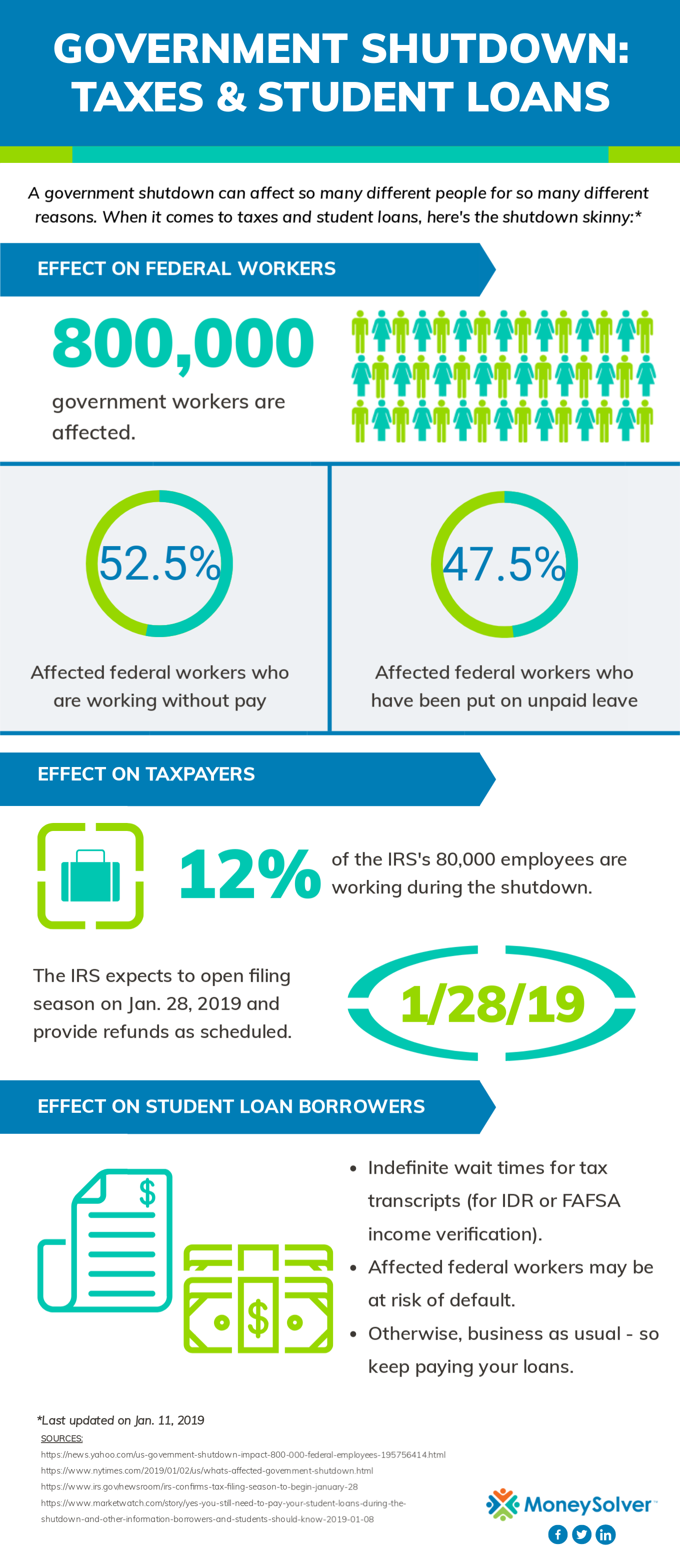

The current government shutdown began on Dec. 22 and was caused over the inclusion of $5 billion in funding for a border wall. This shutdown is technically a partial shutdown because some departments of the federal government are still funded (e.g., The Department of Defense, Social Security, Medicare, and Medicaid). However, the shutdown has affected 800,000 federal workers and even more third-party government contractors who may be left without work or pay. This could have serious implications if it isn’t ended soon. As of Jan. 12, this government shutdown is the longest one since 1973.

How Will Taxpayers Be Affected?

Currently, only 12% of the IRS’s approximately 80,000 employees are still working.

For those concerned about tax refunds, we’ve had some reassurance from the IRS. The IRS has stated that they expect to open the filing season on Jan. 28 and that they intend to provide refunds as scheduled. To do so, they plan to bring back a good amount of their currently furloughed workers to process refunds with no pay. As of Tuesday, Jan. 15, the IRS announced that they expect to have 46,052 employees for tax-filing season, or about 57 percent of its total workforce.

The impact on certain services

Still, certain IRS services like answering taxpayer questions will be severely impacted. Most of the workers on unpaid leave are representatives who respond to taxpayer’s calls, so you may have a hard time getting in touch with someone to answer your questions. The IRS receives more than 95 million calls on its toll-free lines every year. And with the recent tax complications from the Tax Cuts and Jobs Act, there will likely be even more taxpayers calling for help.

With services stinted by the shutdown, it’s unclear how the IRS will be able to provide proper assistance to taxpayers.

What can taxpayers do?

File on time. Don’t let the government shutdown keep you from filing as early as you can when you’re ready. The filing deadline to submit your 2018 tax return is Monday, April 15, 2019, for most taxpayers. However, taxpayers in Maine or Massachusetts have until April 17, 2019, to file their returns due to the Patriot’s Day holiday and the Emancipation Day holiday.

If you have questions about the tax reform changes or your taxes in general, do not expect that the IRS will be readily available by phone to answer any questions. You’ll be better off asking any questions to your tax preparer instead. Here are some helpful tips to get you through the government and IRS shutdown.

How Will Student Loan Borrowers Be Affected?

For most borrowers, the shutdown still means business as usual. The Department of Education is fully funded. So, it can still disperse grants and federal student loans and collect student loan payments.

But there are some other ways the government shutdown could impact student loan borrowers:

- Qualifying for or staying on Income-Driven Repayment Plans: Borrowers may have difficulty qualifying for or staying on Income-Driven Repayment Plans (IDR) plans since the IRS has significantly reduced its activities during the shutdown. These plans require borrowers to provide their student loan servicer with proof of income, which comes from the IRS.

- Applying for aid through the FAFSA: Some students who fill out the Free Application for Federal Student Aid (FAFSA) must prove their income, which again, typically comes from the IRS. With the IRS operating at those minimal levels, it may be difficult to retrieve a tax transcript to verify income.

- Paying student loans as a government worker: Any furloughed government workers who have student loan debt may struggle with repayment. They may have to change their repayment plan or even enter forbearance or deferment if they cannot afford their payments.

What can student loan borrowers do?

Keep making your payments on time! Just because the government is shutdown doesn’t mean you can stop paying your loans.

Are you applying for aid through the FAFSA and having trouble providing verification of income? If so, the Department of Education has announced that institutions may accept a signed copy of your 2016 or 2017 income tax return (as applicable) to verify your income. This should keep you from having to wait for a response the IRS.

The IRS has also announced that they will resume processing request for tax transcripts. Since they’ll have to get through the backlog of requests sent since the shutdown began, the IRS will need more time than usual to process requests. So if you’ve sent in a tax transcript request for proof of income, you may have a wait ahead of you.

Struggling to make your student loan payments because you’re an affected government worker? Your best bet is to call your student loan servicer to discuss your options. Don’t let this difficult time lead to default.

The government shutdown can be overwhelming. Even though some resources are unavailable currently, there are constantly new developments coming to light.

Disclaimer: The viewpoints and information expressed are that of the author(s) and do not necessarily reflect the opinions, viewpoints and official policies of any financial institution and/or government agency. All situations are unique and additional information can be obtained by contacting your loan servicer or a student loan professional.