Supreme Court Blocks Biden’s Forgiveness Plan; What’s Next For Borrowers?

A week after the Supreme Court blocked the Biden Administration’s student loan forgiveness plan, millions of borrowers are still in dismay over the 6-3 decision. Many were hoping to have up to $20,000 of their student loan debt erased. Instead, they are now facing the restart of loan payments in just a few short months. To assist those who may be still struggling financially, the Administration announced that it is working on alternative paths to debt relief, as well as more affordable repayment options. Although these plans are still being finalized, here’s a brief overview of what borrowers can expect.

A One-Year Temporary “On-Ramp” to Repayment

It’s been over three years since most federal student loan borrowers were required to make monthly payments. Although the economy is recovering, many people still aren’t able to meet their financial obligations. Therefore, Biden is offering a 12-month grace period to help borrowers avoid the consequences of late or missed payments. Although missed payments will not count toward loan forgiveness under any of the income-driven repayment plans or Public Service Loan Forgiveness (PSLF), borrowers will not face collection actions or default. Additionally, missed payments will not lead to any negative actions on their credit histories. Interest, however, will continue to accrue during the one-year transition period.

The New SAVE Plan – A Cheaper Repayment Plan

Another option for struggling borrowers will be the new Saving on a Valuable Education (SAVE) Plan. The SAVE Plan, which will replace the current Revised Pay As You Earn (REPAYE) Plan, provides the lowest monthly payment of any income-driven repayment (IDR) plan. It also includes many new benefits for borrowers including:

- An increased income exemption from 150% to 225% of the poverty line. Single borrowers who earn $32,800 or less won’t owe any payments. Most borrowers will save at least $1,000 per year compared to current IDR plans.

- The elimination of remaining interest for both subsidized and unsubsidized loans after a scheduled payment is made. In other words, the loan balance won’t increase due to unpaid interest.

- The exclusion of spousal income for borrowers who are married but file taxes separately. Spouses are not required to cosign on a SAVE Plan application.

How & When To Apply For SAVE

Borrowers already enrolled in the REPAYE Plan will be automatically moved to the SAVE Plan once it’s available. The Administration expects that to be sometime this summer. Those who apply for an IDR plan now and select REPAYE will also be moved to the new program, as well. The other option is to wait for the new application to open, which should take 10 minutes or less to complete. Borrowers may also contact their loan servicers for assistance.

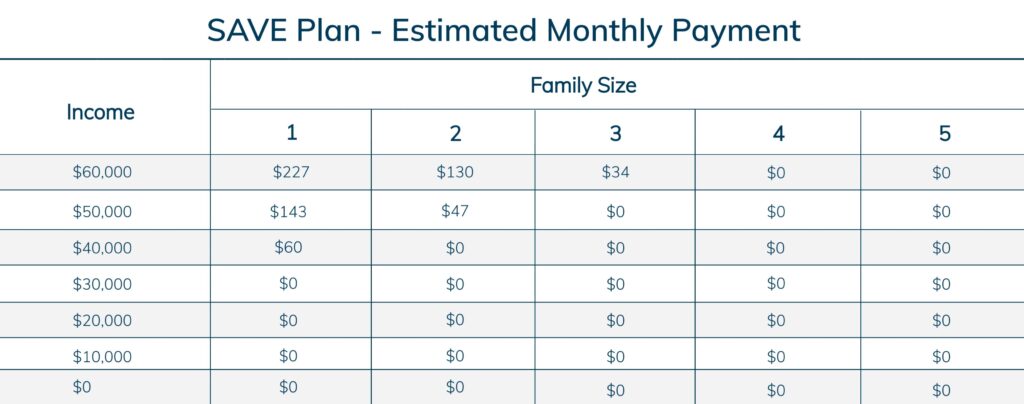

Estimated Monthly Payment Amount

Under the SAVE Plan, monthly payments are calculated using the borrower’s income and family size. Below is a chart that provides the estimated monthly payment for those earning less than $60,000 annually.

Additional SAVE Benefits Starting July 2024

The SAVE Plan will introduce additional benefits beginning next summer (July 2024) that will make it even easier for borrowers to manage their monthly payments, including:

- Undergraduate loan payments will be cut in half. Those with undergraduate and graduate loans will pay a weighted average between 5% and 10% of their income based on their original loan balances (principal only).

- Borrowers with principal balances of $12,000 or less will have their remaining balances forgiven after 10 years of repayment. For balances over $12,000, the repayment period increases by one year for every additional $1,000 borrowed. Previous payments (before 2024) and future payments will both count toward the maximum forgiveness timeframes.

- Those who consolidate will not lose progress toward forgiveness. Instead, they’ll receive credit for a weighted average of payments that count toward forgiveness based upon the principal balance of the loans being consolidated.

- Automatic credit toward forgiveness for certain periods of deferment and forbearance.

- Optional “catch-up” payments that count for all other periods of deferment or forbearance.

- Automatic enrollment in IDR if they are 75 days late on payments and allow the Department of Education to access their tax information.

Student Debt Cancellation May Still Be on The Table

Although the Supreme Court ruled that Biden had overstepped his authority by trying to offer widespread forgiveness under the HEROES Act, the fight may not be over just yet. The Administration plans to pursue a new avenue to relief through the Higher Education Act. Unfortunately, the process will take some time and it is likely to face many obstacles. Additionally, the potential success of this new plan weighs heavily on Biden’s ability to remain in the White House for another term.

Next Steps

If you are worried about the upcoming restart of student loan payments, now is the time to explore your options. Apply for an IDR to ensure you can make the smallest payments possible for your financial situation. If you’re unable to meet the payment amount for your plan, you can also check your eligibility for deferment or forbearance. Reach out to your loan servicer and put together a plan of action to ensure you don’t get behind on your payments or wind up in default. For additional assistance, you can also contact MoneySolver at 855-476-6920 for a free consultation and review your repayment options.