5 Tax Tips to Get You Through the IRS Shutdown and Its Wake

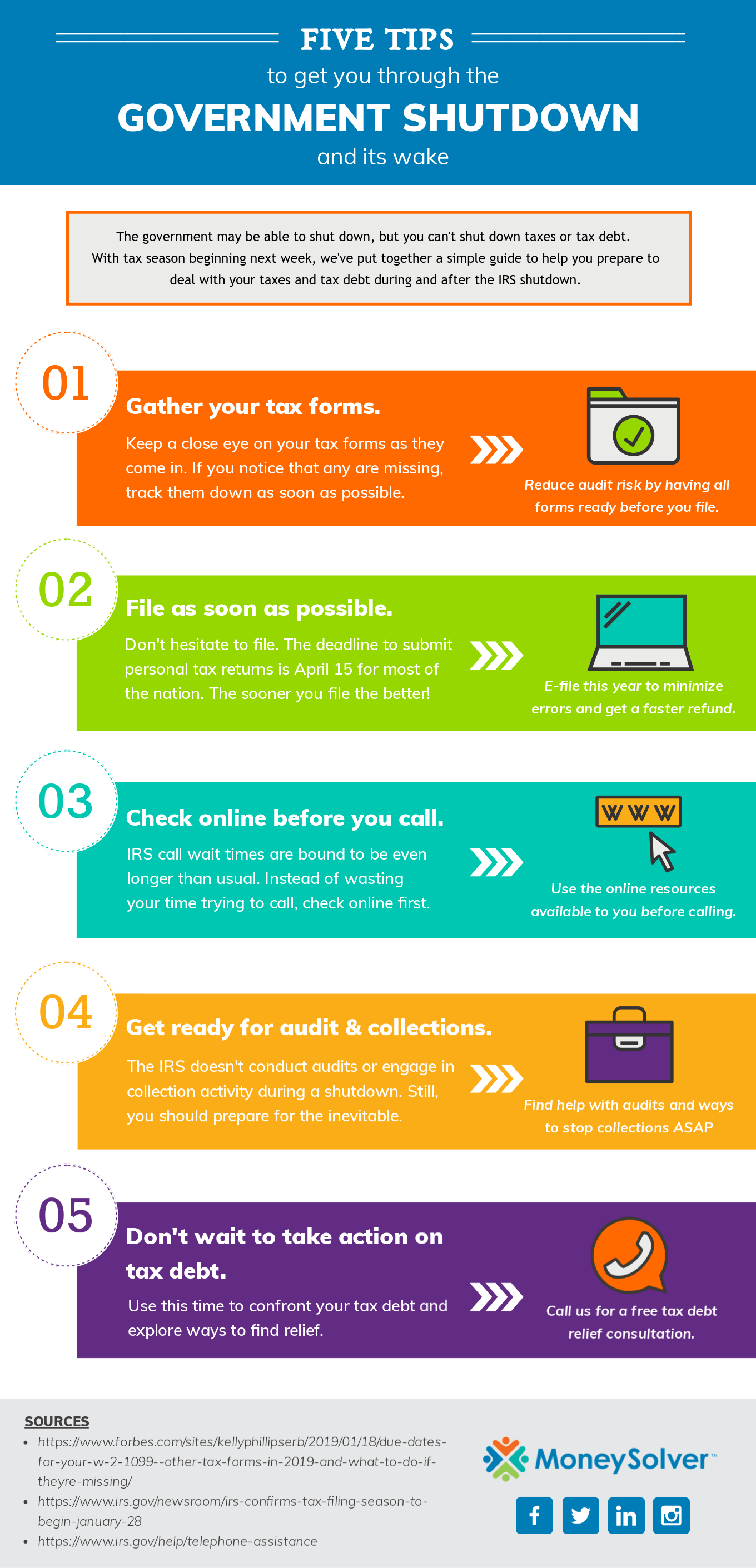

“But if the government is shut down, can’t I just wait to file my taxes or pay back my tax debt?” This is one of the most dangerous thoughts you can have during the shutdown. The IRS shutdown should not keep you from dealing with your taxes or tax debt. The government may be able to shut down, but you can’t shut down taxes or tax debt. With tax season beginning next week, we’ve put together a simple guide to help you prepare to deal with your taxes and tax debt during and after the IRS shutdown.

Tips to Help You Make Your Way Through The IRS Shutdown And Its Aftermath:

1. Gather all your tax forms.

Make sure all your tax forms arrive on time. If they don’t, make sure you check your records to ensure you didn’t receive any missing forms earlier than expected.

If you still cannot find some of your necessary forms, be sure to reach out ASAP to the responsible party. The IRS may not be available by phone due to the shutdown. So, you will want to put extra effort into contacting the issuer of the form you need. If you’re missing a W2 form, be sure to contact the responsible employer before considering reaching out to the IRS. You’ll want to make sure you have all the tax forms needed before you file, otherwise you could be at risk of an audit.

2. File as soon as you can.

Once you have all your tax forms, don’t hesitate to start filing. The deadline to submit personal tax returns for most of the nation is April 15, 2019. The only exceptions to this deadline are for Maine and Massachusetts residents, who have until April 16 to file, and District of Columbia residents, who have until April 17.

If you do think you’ll need an extension past these deadlines, you can seek one from the IRS or state taxing authority. Just keep in mind that an extension is an extension to file, not to pay. So if you owe, you must pay on time. You’ll want to keep a copy of your extension too as proof that you filed one.

Also, you should consider e-filing this year. The IRS has strongly encouraged taxpayers to file their returns electronically in order to minimize errors and receive faster refunds.

3. Check online before you call.

The average wait time for the IRS between April 2016 and April 2017 was about 70 minutes. Even with the IRS bringing back 36,000 furloughed workers to work without pay, there’s no telling how long wait times will be now during and after the government shutdown. If you do call, you’ll need to maintain plenty of patience.

And if you were thinking of going to a walk-in taxpayer assistance center (TAC) or sending the IRS something via mail, you’ll be out of luck. The TACs are closed during the IRS shutdown and the IRS has said they will be responding to mail “to only a very limited degree during this lapse period.” Your best bet will be to use the IRS’s online resources to address any questions you have.

4. Get ready for the rigor of audits and collections once the shutdown ends.

During the IRS shutdown, they won’t be conducting audits or actively engaging in collection activity. You’ll still get automated initial contact letters about audits and any automated collection activity will continue. Just because they won’t be auditing or partaking in collection activities doesn’t mean you should put your feet up and relax.

In fact, this is the perfect time for you to prepare yourself and your paperwork for the inevitable. The government can’t stay shut down forever. And once the IRS is up and running again, they’ll be starting up those audit and collection processes in full force. You don’t want to be caught unprepared for something like that. Make sure you find tax audit help as needed and start looking into ways to stop those collection activities.

5. Don’t wait to take action on an outstanding tax debt.

A government shutdown may seem like the perfect time to avoid your tax debt. It gives you so many excuses not to resolve your IRS bill: it’s hard to reach the IRS, they won’t be pursuing you actively, you may not be getting paid if you’re a furloughed government worker or third-party government contractor, etc.

Don’t let any of these excuses stop you from taking that first step towards freedom from tax debt. Instead, take this moment to confront your tax debt and explore ways to find relief. Our tax professionals can walk you through ways to get tax relief help during a free consultation. And if you’re struggling with tax debt, why not enter our #PayMyTaxes Contest for your chance to win up to $50,000 towards your IRS bill? Click here to apply to the #PayMyTaxes Contest.

At the end of the day, this IRS shutdown has come at an unfortunate time, coinciding with the first tax season that includes all the tax reform changes that came with the Tax Cuts and Jobs Act. If you need any help figuring out your taxes or finding back taxes help, our team is always here to help.

*Read the original post on our Tax Defense Network blog