4 Ways the #PayMyTaxes Contest Could Change Your Life

We couldn’t be more excited to finally announce our first-ever #PayMyTaxes Contest. MoneySolver’s #PayMyTaxes Contest gives entrants a life-changing opportunity to have up to $50,000 in tax debt paid off. Yep, you read that right. $50,000! We’ve even been interviewed by News4Jax about this awesome opportunity.

Here are four ways that the MoneySolver #PayMyTaxes Contest could help you change your life:

1. Winning the #PayMyTaxes Contest = reduced stress and space to finally breathe.

Studies have shown that people who struggle to pay off their debts are more than twice as likely to experience depression and anxiety. But what if that struggle was lifted off your back?

If you were to win up to $50,000 in tax debt off your back, you’d be able to take much more than just a huge sigh of relief. The winner of the #PayMyTaxes Contest will be able to brush that tax debt stress off and bask in some serious relaxation.

2. Higher likelihood of avoiding unpaid tax debt risks, like wage garnishment and liens.

No one wants to face collection activities. But if the amount you owe decreases (or disappears), it’ll be easier for you to avoid the consequences of unpaid tax debt.

Of course, if you still have some tax debt left over after that $50,000 is paid off, you’ll still have to pay the IRS the remaining amount to avoid collections. However, you’ll be a little closer to freedom from tax debt!

3. Lowered tax burden, which lessens your financial load.

Paying off your tax debt in full can be nearly impossible for some people. But the winner of the #PayMyTaxes Contest will suddenly find themselves free from up to $50,000 in tax debt.

That’s a lot of money that you’ll no longer have to pay, which means a much lighter financial load for you in the long run.

4. Lessened financial load = more freedom.

No more worrying about how your tax debt might affect your spouse or what happens with your tax debt when you die. With less of a financial burden on your shoulders, you’ll be able to explore the things you love and stop worrying about your tax debt.

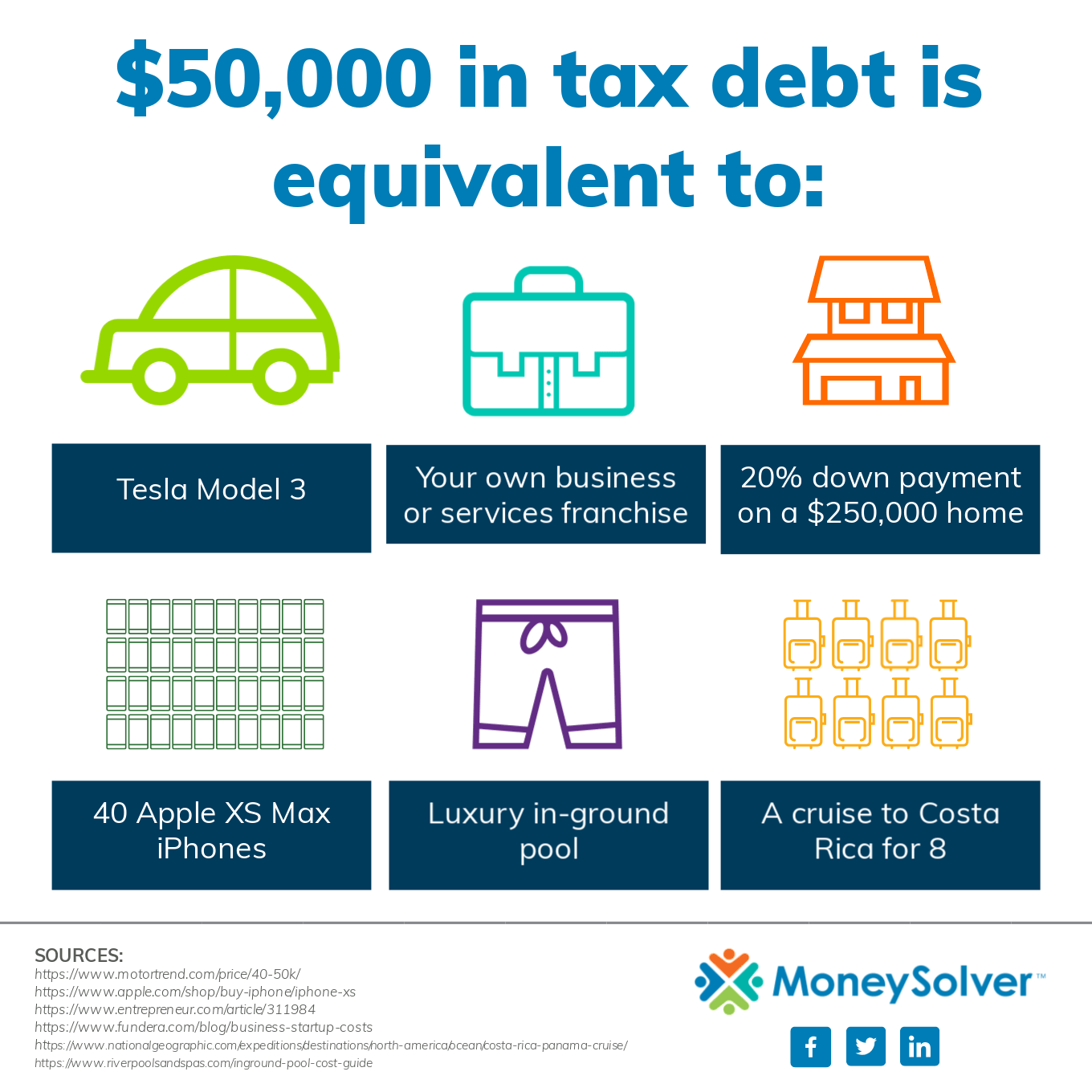

Instead of having to pay $50,000 towards your IRS tax debt, you’ll be able to use that money to live your life. The cash that you would’ve used to pay the IRS could go towards something much more meaningful to you. And honestly, if given the choice, wouldn’t you rather spend $50,000 on yourself than on your tax debt?

So, what are you waiting for? With the chance to win $50,000 towards your tax debt and change your life, send in your application for the #PayMyTaxes Contest before the deadline of May 31, 2019. We’ll be notifying the lucky winner on or around July 4, 2019.