Why Staying in the Student Loan Default Pit Could Make Things Worse

Paying back student loans isn’t fun. In fact, it often feels like your paycheck barely touches your bank account before it goes towards your loan repayment. And the loan servicers don’t care if your new car payment AND loan liability make it hard to afford date night. One slip too many and you could be spiraling down into the student loan default pit…

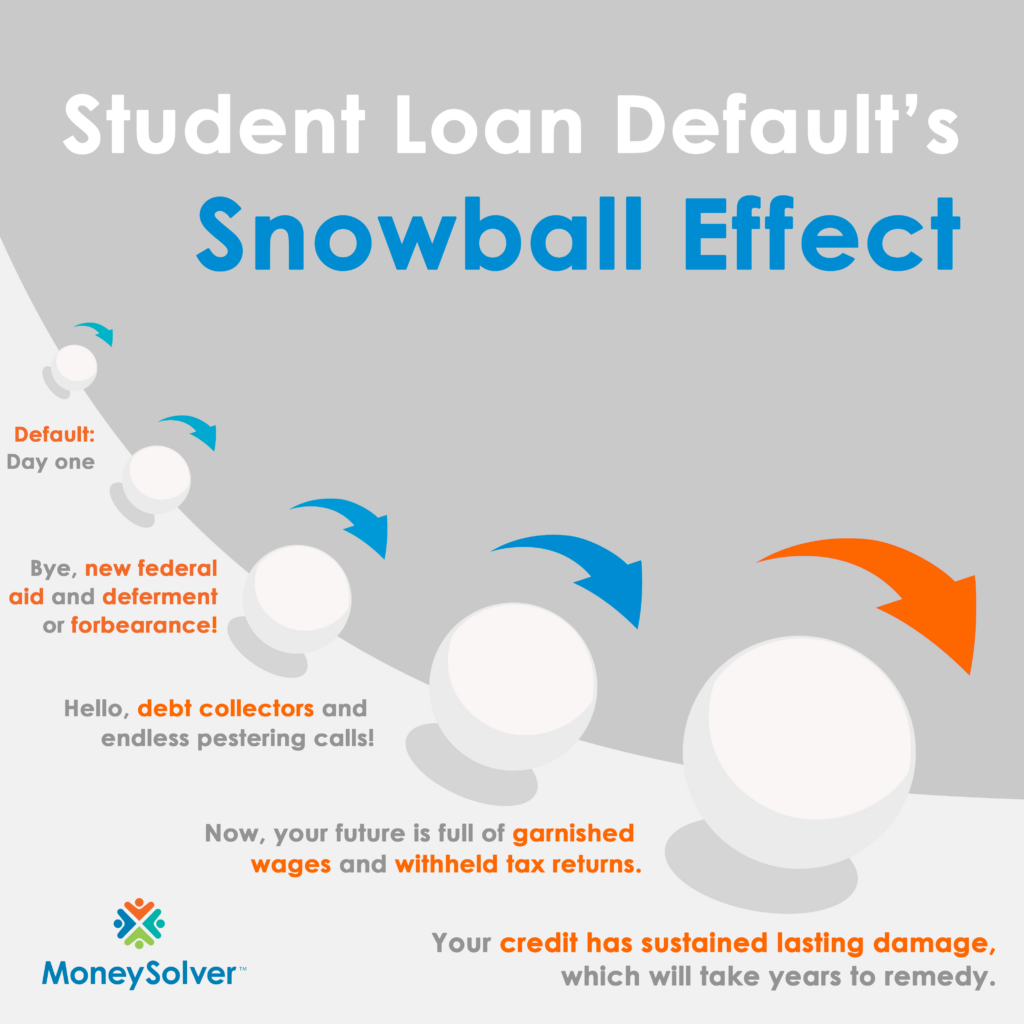

It can be unbelievably easy to fall into the student loan default pit. It’s so easy, one million people default on their student loans each year. It even looks like nearly 40 percent of borrowers may default on their student loans by 2023. And student loan default can have a lasting impact on your financial future. In fact, it can cause a huge snowball effect. And if you don’t stop that snowball before it gets completely unmanageable, you’re in for a rough time.

What is Student Loan Default?

The first day after you miss a payment, your loan becomes delinquent. After being delinquent for a certain amount of time, your loan will go into default. The time frame varies depending on your loans. However, you’ll generally fall into default if you don’t make any payments for 270-360 days.

A student loan default is the failure to repay a loan according to the terms of your loan. When you are in default, the entire unpaid balance of your loan (plus any interest you owe!) becomes immediately due. This means your lender has the right to take legal action to get that money back.

A student loan default often snowballs into even more debt – thanks, accumulated interest! Unfortunately, a student loan default can also snowball into even worse situations.

4 Ways Default Makes Things Worse

There are so many messes that a student loan default can create in your life. Some of those messes are more extreme, like your servicer taking you to court or your school withholding your academic transcript. But there are some very real and almost inevitable effects of a student loan default that will happen as soon as you go into default.

1. You won’t be able to take out any new federal aid and you’ll lose eligibility for forbearance or deferment.

The moment you fall into default, you become unable to take out any new federal student loans. If you’re still working to complete school, this could leave you without a degree but still stuck with tons of student debt.

You may have had access to forbearance or deferment before. But you won’t be able to seek either of these options after you fall into default. This robs you of the chance to get back on your feet or have any breathing room before you have to pay back your loans.

2. Debt collectors will start to hound you.

Once your loan is in default, your servicer will sell it to a collections agency. So, get ready to receive a never-ending string of phone calls from debt collectors trying to collect payments.

Besides these super-annoying calls, you’ll also have collection fees added onto your loan balance. These fees are a commission for the collection agencies’ services. So even if you are working with the debt collector to pay off your loan, know that you’re also paying off their collection fees. Collection fees and interest on a loan can be larger than the monthly amount being paid to collections. This can cause you to make payments without actually paying off your loans. In these situations, loan balances can even increase and leave you in more debt than before.

3. Your wages will be garnished and you could lose your tax refund.

It can become too real when your wages and tax returns are taken to repay your defaulted student loans. The Department of Education can and will have a wage garnishment order placed on you until your student loans are settled. This means that your employer would withhold part of your paycheck and send it to your servicer to go towards your defaulted loan.

The Department of Education can also refer your account to the IRS. The IRS will then withhold any tax refunds and federal benefit payments and apply these towards the repayment of your defaulted loan. So, kiss your wages and tax returns goodbye when you enter student loan default.

4. Your credit will take a serious hit.

Your servicer will report your student loan default to credit bureaus, which will damage your credit rating. Because default and late payments stay on your credit report for years, it can take a while to reestablish a good credit record. This can impact your ability to get a credit card or buy a car or house in the future. You don’t want to have your dreams hampered just because you fell into default.

Is There Any Easy Way Out of Student Loan Default?

Yes, there are ways to escape the student loan default pit, and they don’t require an ice ax. Most of these ways involve making arrangements with your servicer to repay the loan. Even if your default has snowballed out of control, you always have options.

Disclaimer: The viewpoints and information expressed are that of the author(s) and do not necessarily reflect the opinions, viewpoints, and official policies of any financial institution and/or government agency. All situations are unique and additional information can be obtained by contacting your loan servicer or a student loan professional.