How Student Loans Affect Credit: Will Your Score Improve or Decline?

Oh, the joys of being an adult! Once you leave college, you find that there’s so much (too much, sometimes) that goes into functional adulthood. Some of those #adulting requirements – paying your bills, doing laundry regularly, etc. – are easy enough to understand and conquer. Others are tougher nuts to crack, like building your credit score and repaying your student loans. Trying to balance those two at the same time can leave your head spinning. Once you have a better grip on how student loans affect credit, you should be able to set a plan to successfully adult in both arenas.

First thing’s first, what even is a credit score?

A credit score is a number between 300 and 850 that tells lenders what your creditworthiness is. This number is powerful – it can influence whether you’re approved for loans and how high or low your loan interest rates are. The closer to 850 your credit score is, the better. But the closer to 300, it’s more likely that you won’t get approval for loans or you’ll only qualify for high interest rates. This number can vary across the three credit bureaus and the Fair Isaac Corporation, which publishes the popular FICO scores.

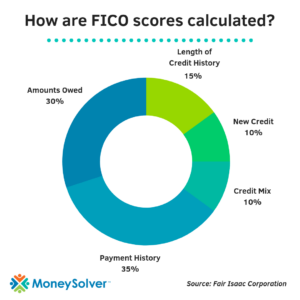

Your credit score is determined by payment history, amounts owed, length of credit history, new credit, and credit mix. You can see below how these factors impact your FICO score.

What do student loans have to do with credit?

Your student loans affect credit reports and scores in many ways, both positively and negatively. Student loans can help you successfully improve your credit and prepare for greater things in adulthood. But, they can also tank your credit score if you have issues making payments on time.

This doesn’t only apply to college students with student loans. Parent PLUS loans also affect credit, but these loans only affect the parent’s credit score, not the student’s.

Positive ways that student loans affect credit

1. Establish credit and build credit history

If you haven’t ever had any credit cards or loans, your student loans could be your first foray into the wide world of credit. This is nothing to feel bad about. There’s no time like the present to start establishing credit! Having student loans will put something on your credit report and keep you from being credit invisible.

If your student loan has a longer repayment period (say, 10 years or so), it’ll also help you build a long credit history. And while balances on credit cards can hurt your credit score, a high student loan balance doesn’t mean your credit has to suffer. According to FICO, seven percent of consumers with more than $50,000 in student loan debt have FICO scores in the 800s.

2. Diversifying credit mix

Student loans are considered installment loans, like a home mortgage or auto loan. Already have a credit card (which falls into the category of revolving loans)? Adding an installment loan like a student loan to your credit report can create an instant credit mix for you. While credit mix only affects 10 percent of your score, it can still help give you a little boost, especially if you don’t have an extensive credit history.

Do know that, once you pay off your student loans (hooray, future you!), your credit score may dip if student loans are your only open installment loan. This is no reason to avoid paying off student loans, but it’s good to know.

3. Making payments on time

Payment history is the biggest factor that goes into your credit score. It accounts for the largest individual percentage of your FICO credit score. Making on-time, consistent payments can make your credit score skyrocket. Especially if you make timely payments across the lifespan of the loan, you’re setting your credit score up for success with a long, strong payment history.

Negative ways that student loans affect credit

1. Applying for new private student loans

Anytime you apply for any new private student loans, the lender will run a credit check on you. These inquiries into your credit will show on your credit report. This results in a slight, short-term dip in your credit score. In general, any student loan shopping inquiries made during a focused time period (like 30 days) will have little to no impact on your score. And if it does have a small impact, it’s typically only going to decrease your score by a few points.

2. Opening many student loan accounts

Every disbursement of a student loan can count as its own loan on your credit reports. Each of these individual loans will increase your overall debt balance and your debt-to-income ratio. With that much more debt, it may be harder to qualify for a loan or credit line later, even with a good credit score.

3. Making late payments and defaulting

Any missed or late payment can make a big, bad impact on your credit score. The first missed payment can even cause a good credit score to fall up to 110 points. Even worse, falling into student loan default can do long-lasting damage to your credit score that could take years to remedy. There are plans that can help you get out of default, which will remove the default from your credit history. However, the history of late payments will remain. So, knowing your payment plan options and how to make your payments can make a world of difference for your credit score.

However, you should know that deferment and forbearance do not hurt your credit score. These options aren’t ideal and the loans will still be on your credit report. Still, your credit score won’t be penalized for loans in deferment or forbearance.

If you ever want to see how student loans affect your credit score, you can get a free copy of your credit reports from each of the major credit bureaus annually by requesting them individually or going to AnnualCreditReport.com. There are also services, like TaxSafe™, that can help you track your credit. Being aware of your credit score’s changes is a solid step towards using your student loans to you and your credit’s advantage.

Disclaimer: The viewpoints and information expressed are that of the author(s) and do not necessarily reflect the opinions, viewpoints and official policies of any financial institution and/or government agency. All situations are unique and additional information can be obtained by contacting your loan servicer or a student loan professional.