What to Do About Student Loan Repayment After Graduation

Welcome to adult life! You’ve conquered the daunting task of graduating from college. Now, you’re off to prove that you can function in this crazy world of ours. But that’s much easier said than done. And there may still be a shadow hanging over you from school – your student loan debt. How do you handle student loan repayment after graduation while dealing with the whirlwind of adulthood?

There’s a lot to consider when it comes to repayment, from the types of loans you have to making your first payment after your grace period. Let us break it down for you piece-by-piece.

First Thing’s First: What Types of Loans Do You Have?

Before you can even begin to tackle your student loans, you’ll need to answer one question: What types of loans do you have? This seems simple enough, but many people can’t answer with certainty. The differences between federal student loans and private student loans are important to consider when it comes to repayment options.

If you have federal student loans, you may have more options available to you when it comes to repayment plans, forgiveness programs, forbearance and deferment, and borrower protections. Some private loan providers will offer a few of these options, but there’s no guarantee.

But How Do You Find Out What Loans You Have?

If you have federal student loans, you can find out which ones you have by using the National Student Loan Data System (NSLDS).

You’ll need an FSA ID, which you may have made when you previously filled out the Free Application for Student Aid (FAFSA). If you don’t have one, you can create one.

Once you log into your account, you’ll be able to see all the federal student loans that you received. This page will include information on the original loan amounts, the current balances, the loan type, your interest rate, and the loan servicer. However, if you have private student loans, it’ll be a little harder to figure out what loans you have.

There’s not really an NSLDS equivalent for private student loans. However, you may be able to use something else to help you out: your credit report.

When you pull your free annual report from one of the three main credit bureaus, you can look through the lenders listed. If the lender’s name isn’t familiar to you, search for them online to find out what company you took out a private student loan through. Your credit report should also offer you contact information like the lender’s phone number.

Additionally, your college’s financial aid office may be able to offer you a list of your loans.

The Sweet Relief of an Amazing Grace Period

Here are two words that should be music to your ears: grace period. A grace period is a period of time after you graduate, leave school, or drop below half-time enrollment before you have to start repaying your student loans. Grace periods should give you some relief while you prepare to start repaying that hefty student debt bill.

Not All Grace Periods Are Created Equal

All federal loans (except PLUS Loans and some Federal Perkins Loans) have a grace period of six months. This includes Direct Subsidized Loans, Direct Unsubsidized Loans, Subsidized Federal Stafford Loans, and Unsubsidized Federal Stafford Loans.

Those with PLUS loans and Perkins Loans may have a grace period, but it may not be as automatic or as long as the grace period given for other federal student loans.

And if you have private student loans, you’ll need to check with your servicer to see if you will receive a grace period. Not all private loan servicers offer this benefit.

One thing you’ll want to keep an eye on with Unsubsidized Loans and PLUS Loans during a grace period: they will gain interest even when you’re not in repayment. That interest will be added to your principal amount when your grace period ends. So, making payments on these loans during your grace period could help lower your total amount in the long-run.

Let’s Talk About Student Loan Repayment Plans

Once your grace period is up, you’ll want to sign up for a repayment plan that works for you. Pick a plan with monthly payments that you know you can afford and that will help you meet your own personal goals.

Say you want to pay the least amount of interest possible and pay off your loans quickly. In this case, you’d want to pick the standard repayment plan, where you make equal monthly payments over 10 years. But if you need lower payments or are interested in certain types of student loan forgiveness, income-driven repayment plans may be a better choice.

Your repayment plan options will vary depending on what types of loans you have. For instance, income-driven repayment plans are typically only available for federal student loans. Federal student loan repayment plans are laid out cleanly for all federal borrowers. However, private student loan repayment plans are highly dependent on your servicer. If you have private student loans, you’ll need to ask your servicer what repayment options exist for you.

Your First Student Loan Payment After Graduation

Once your grace period is up and you’ve selected your repayment plan, it’s finally time to make your initial post-graduation student loan payment. Taking this step towards student loan repayment after graduation should be the simplest part yet – so long as you have the money for it!

Your servicer wants you to pay them back, so you should have a few different options for payment. You can pay manually (through their website, over the phone, or via mail), set up autopay directly with your servicer, or set up autopay with your bank. If you have any issues making your first payment, you can always contact your servicer directly.

If you can comfortably pay more than your monthly payment, that’s awesome. Paying off your student loans early can help you minimize the amount of interest you’re paying over the life of your loans. Just be sure that your extra payment is going towards your principal balance and not being held as prepayment for the following month.

Avoid Default and Delinquency Like the Plague

What if your grace period is up after graduation but you’re not ready to enter the repayment period?

What if you’ve already started repaying your student loans but you lose your job?

Can anything be done if you find yourself running behind on your monthly student loan bills?

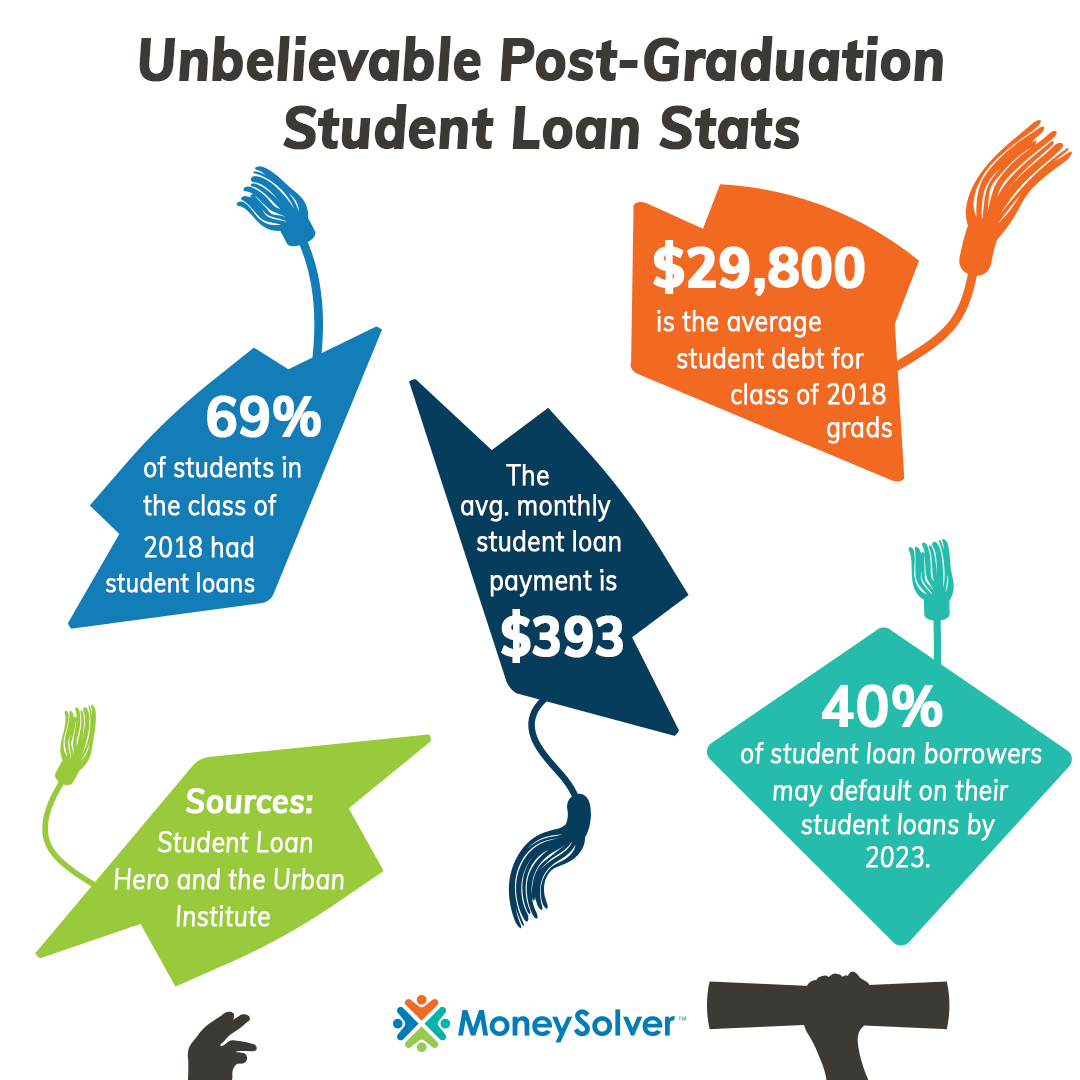

No matter what hardship you find yourself in, you want to do your very best to avoid falling into delinquency or default on your student loans. Finding yourself in the default pit can have particularly difficult consequences for your credit and future finances.

The best way to steer clear? Be honest with yourself about what you can handle financially.

If you sense that you may not be able to handle your monthly payments, don’t be ashamed. Be frank and upfront about it. Explore options like switching payment plans or forbearance and deferment that might make your life a little easier. There are plenty of student loan services like our Student Loan Solver that exist to help you figure out the best way to move forward.

Student loan repayment after graduation should be easy. But often it can be a pain to figure out where to start. If you’ve still got questions and don’t know where to turn, give our team of Student Loan Advisors a call. They’ve got the experience and skills needed to help move you in the right direction.