What the Navient Lawsuit Means for Americans with Student Loans

Think back to when you finished college. Were you actually thinking about paying back your student loans? More likely than not, you were more preoccupied with the terrifying prospect of facing the “real world.” So when your grace period ended, you hadn’t considered which repayment plan would work best for you. You might have relied on your loan servicer to tell you which options would be a good fit for you. And if your loan servicer was Navient, one of the biggest student loan servicers, you may have been misled. In fact, the U.S. Consumer Financial Protection Bureau (CFPB) filed a Navient lawsuit, suing the company for the harm their borrowers may have experienced in being misled or misinformed.

So, what’s going on with the Navient lawsuit?

The past two years have been rife with controversy over Navient’s practices:

- Jan. 2017 – Three Navient lawsuits were filed: one by the U.S. Consumer Financial Protection Bureau, one by the Illinois attorney general, and one by the Washington attorney general.

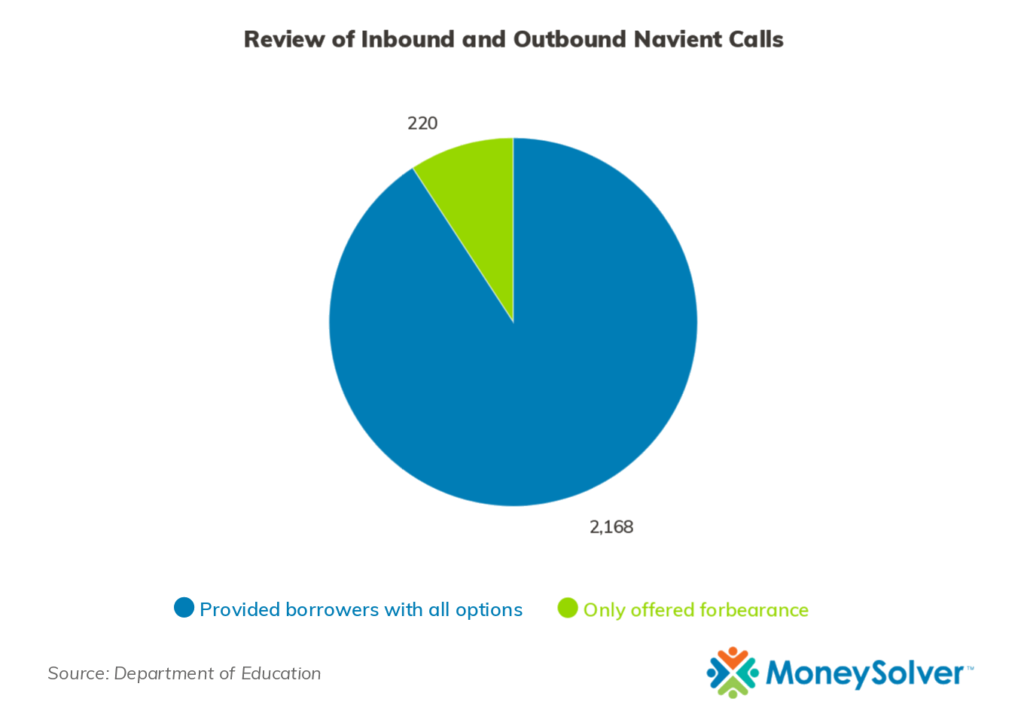

- May 2017 – The Department of Education reviewed Navient’s inbound and outbound calls to investigate whether or not Navient was steering borrowers into forbearance. They found that during 220 out of 2,388 calls, a Navient representative only offered forbearance to the borrower without providing all options available. In some of these instances, interest was capitalized when it may not have been if another option had been offered and accepted by the borrower.

- Oct. 2017 – Pennsylvania’s attorney general filed a lawsuit against Navient.

- June 2018 – The attorney general of California filed a Navient lawsuit.

- July 2018 – Mississippi attorney general jumps onboard the Navient lawsuit train and files their suit.

- Nov. 2018 – Sen. Elizabeth Warren of Massachusetts provides the Federal Student Aid report to The Associated Press and posts it online.

The main complaints about Navient are misallocated payments, steering struggling borrowers towards forbearances instead of income-driven repayment (IDR) plans, and providing unclear information about how to re-enroll in IDR plans and how to qualify for a co-signer release.

The President and CEO of Navient, Jack Remondi, has responded to the report and maintains that “Navient overwhelmingly performs in accordance with program rules while consistently helping borrowers choose the right options for their circumstances.” His response does not fully speak to the issues brought up in the report though and the lawsuits filed are still in process.

What does it have to do with me?

Is Navient your student loan servicer?

If your student loan servicer is Navient, don’t get your hopes up just yet. The CFB is requesting compensation in their lawsuit with Navient. However, it’s unlikely that you’ll see any of that compensation any time soon. There isn’t a forgiveness option for you that is specific to Navient’s questionable practices. If you’re looking for forgiveness, your best bet is going to be pursuing one of the currently available forgiveness programs, like the PSLF or IDR plan forgiveness. Keep in mind that forgiveness through these programs isn’t immediate and has strict requirements.

You could switch servicers by consolidating or refinancing your student loans. But there’s no guarantee that your new servicer will actually be much better than Navient. You could also lose any progress you’ve made towards forgiveness and any opportunities like deferment by refinancing.

You could also continue to work with Navient as your loan servicer. You’ll just need to keep in mind that they do not necessarily have your best interests at heart. As you pay off your student loans with them, be sure to double-check your options with a student loan services professional.

Have a student loan servicer other than Navient?

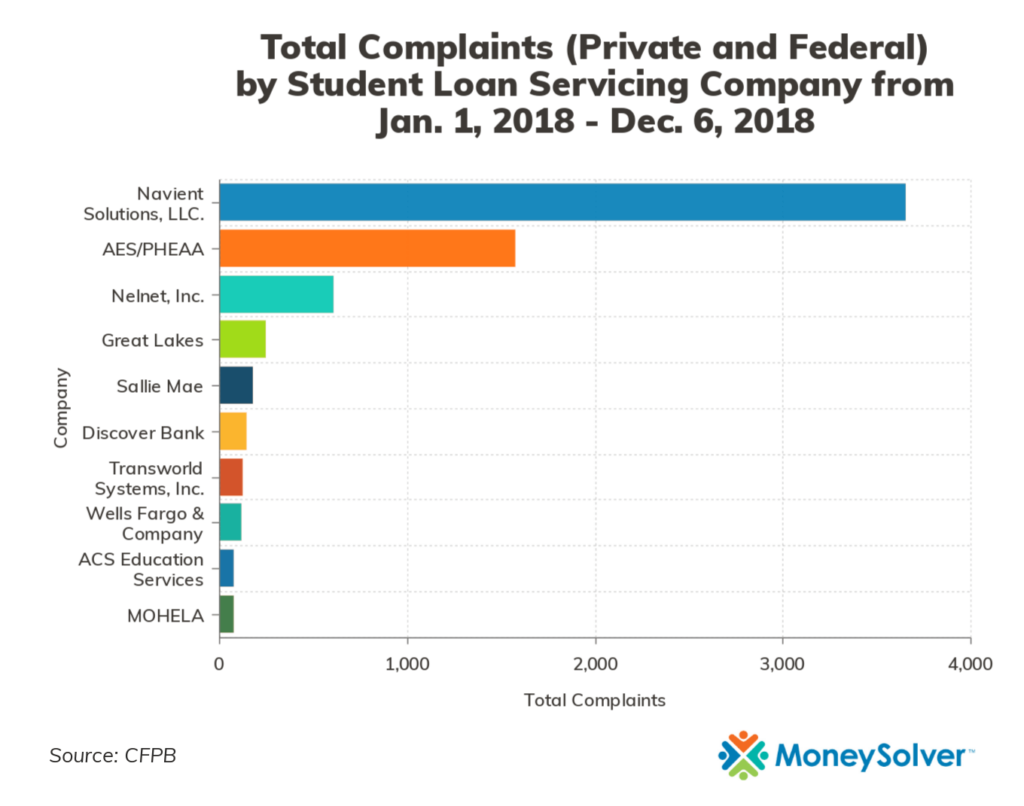

Even if you have a different student loan servicer, this Navient lawsuit should be eye-opening. While they may have better practices than Navient, your servicer does not operate in your favor. Navient has received the most complaints in 2018 so far, but the other servicers have also seen plenty of complaints.

It’s so important for you to understand your borrower rights and what repayment options are available to you. You cannot depend on loan servicer representatives to give you the full picture on your loan repayment options. But you can take comfort in knowing that there are services out there (like our Student Loan Solver) that can help you research your options and find the best fit for you.