How to Qualify for Public Service Loan Forgiveness Like a Boss

Working your way towards student loan forgiveness can feel like you’re running the longest race ever. You can see the dreamy goal of having your loans forgiven at the finish line ahead of you. But there are so many hurdles between you and your goal. How can you be sure to clear those hurdles with ease and put yourself that much closer to sweet forgiveness? Here’s your crash course on how to qualify for public service loan forgiveness (PSLF) and come out victorious.

What You Should Know about Public Service Loan Forgiveness

Public service loan forgiveness seems straightforward. That’s what is so dangerous about it. Many people are at a loss when it comes to PSLF’s intricacies. The facts are these:

Many people apply for PSLF – but few get approval.

There are currently over a million borrowers who have taken steps towards PSLF, and even more who could take steps towards PSLF but don’t know enough about it.

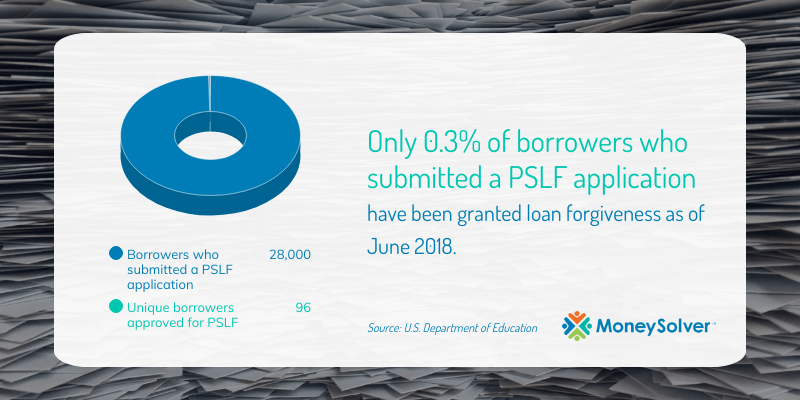

As of June 2018, 28,000 borrowers had applied to have their loans forgiven through PSLF. However, only 96 of those borrowers were successful in having their student loans forgiven. This means that more than 99 percent of PSLF applications were rejected. Why? Most of the rejected borrowers found out too late that they weren’t eligible. So how do you make sure you’re eligible? We’ll cover that soon.

Loan servicers aren’t much help.

We know that servicers are not always on your side. There have even been many complaints from borrowers who claim that their servicers have negatively impacted their attempts to seek PSLF.

These complaints include:

- Wrong or lacking information about eligibility for PSLF, even after borrowers have mentioned that they are public service workers.

- Delays and errors in processing that interrupt and prevent borrowers from making qualified payments towards PSLF.

- Inability to help keep track of borrower’s progress towards forgiveness.

There are drawbacks to PSLF.

Sure, PSLF will forgive your debt with no current cap. But it will still take you a whole decade working for a qualifying government agency, nonprofit, or other organization. That’s 10 years of your life dedicated to one career goal with your student debt tying you to your job. Depending on your loan balance and situation, it may be better for you to pay off your student loans faster.

PSLF could drastically change or cease to exist in the future.

Based on recently proposed changes, Public Service Loan Forgiveness may not continue to exist as it does today (or at all).

The current administration has proposed ending the PSLF program. If this proposal passes, it would presumably not affect borrowers who have already taken out student loans. However, it would impact any borrowers who take out loans on or after July 1, 2020. Instead, supporters of the proposal argue that all borrowers can find forgiveness through income-driven repayment plans. Meanwhile, opponents of the proposal are concerned about limiting forgiveness programs and penalizing public servants who often earn less but serve the community.

What You’ll Need to Qualify for a Public Service Loan Forgiveness Win

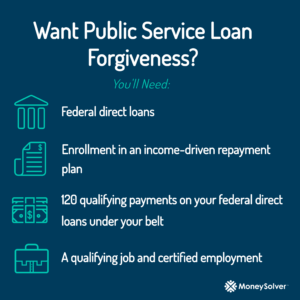

The right types of loans

It would be awesome if PSLF existed for every student loan under the sun. Unfortunately, only one specific type of loan qualifies: federal direct loans. This means that private student loans and other types of federal student loans will not qualify you for PSLF. You may be able to consolidate other federal loans into a direct consolidation loan to qualify. However, even if you’re able to do this, your previous payments on your loans will not count towards the qualifying payments requirement.

Not sure what type of loan you have? No worries. You can check the National Student Loan Data System to find out.

Enrollment in an income-driven repayment plan

Standard and graduated repayment plans are great and all, but they won’t help you if you want to get PSLF. You must have an income-driven repayment plan to qualify for forgiveness in this program. An IDR plan will maximize how much you should have forgiven while reducing your monthly payments.

Many borrowers who found they were ineligible for PSLF were not enrolled in the correct plan. Congress attempted to fix this issue with a $350 million fund to offer forgiveness to borrowers who meet all PSLF requirements but were enrolled in graduated or extended repayment plans. This forgiveness will be given out on a first-come, first-served basis until the money runs out. However, this amount is not enough to cover all borrowers who would be eligible for it. Other attempts have been made to secure more money for this type of forgiveness but there hasn’t been any clear progress yet.

A minimum amount of qualifying payments

If you thought you could qualify for student loan forgiveness without paying on your loans at all, we’ve got some bad news. That’s near impossible.

For PSLF, you’ll have to have made 120 qualifying payments on your federal direct loans. That adds up to about 10 years of payments. Qualifying payments are payments that you make by the due date, or up to 15 days later if something went wrong and you missed the deadline.

There are two important things to note about qualifying payments:

- Qualifying payments don’t need to be consecutive.

- Making extra payments towards your student loans doesn’t count towards the qualifying payments. This includes paying more than required monthly and paying while you’re still in school.

- Late payments and partial payments don’t count as qualifying payments either.

A qualifying job and certified employment

To qualify for PSLF, you’ll need to be employed full-time (that’s more than 30 hours per week) in an eligible federal, state, or local public service job. Certain non-profit jobs can also meet this qualification.

You’ll want to certify your employment with your servicer annually or when you switch jobs. When you certify, your servicer should tell you how many qualified payments you’ve made. This can help minimize the chance for problems down the line. Also, maintaining good records of this certification, your W-2s, and your student loan payments can help prove you’ve met the requirements if needed.

What to Do If You Can’t Qualify for Public Service Loan Forgiveness

Don’t let this setback get you down and don’t stop making payments. The last thing you want to do is fall into the default pit. There are other ways to deal with your student loan debt, even if you’re struggling.

Other types of student loan forgiveness exist that can help discharge some of your student loan debt. For temporary relief, you may be able to get forbearance or deferment to help you get back on your feet. There are other options out there for you. Give us a call and our student loan experts can help you find the best solution to your student debt.

Disclaimer: The viewpoints and information expressed are that of the author(s) and do not necessarily reflect the opinions, viewpoints and official policies of any financial institution and/or government agency. All situations are unique and additional information can be obtained by contacting your loan servicer or a student loan professional.