How to Get a Student Loan Before Your Tuition is Due

Congratulations on your acceptance into the school of your dreams! College is right around the corner, so you have every right to feel excited. You’re bound to meet some amazing new friends and learn from incredibly wise professors. The only catch? That dreaded tuition payment. Most students need a little bit of help footing the bill for their education, which can come in the form of student loans. In an ideal world, you wouldn’t have to borrow any money from college. Scholarships and grants would cover all your college costs and you would graduate with $0 in debt. But that’s not the reality for many students. So, we’ll show you how to get a student loan in time to pay those college bills and start your first semester without worry.

Where do I start?

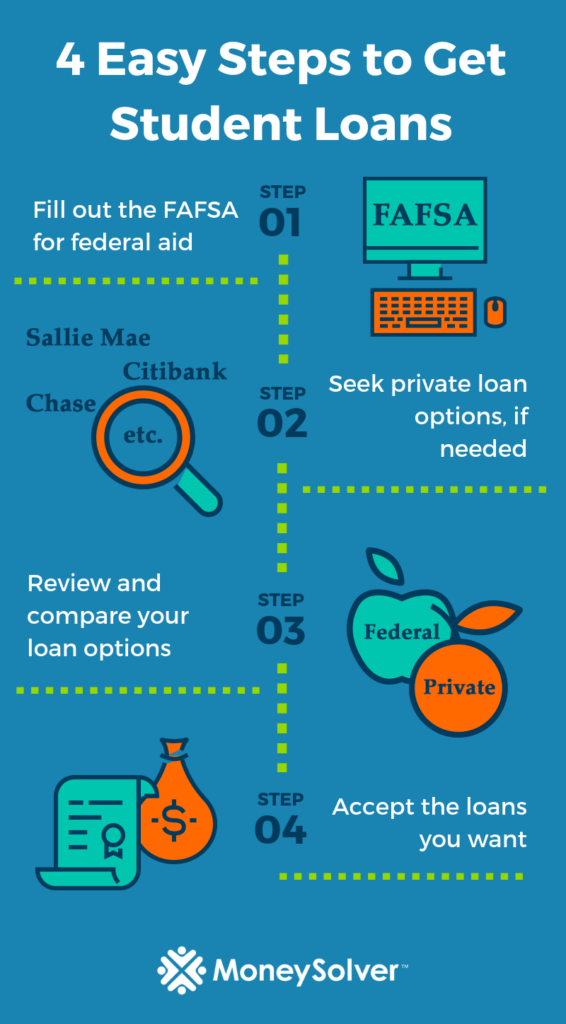

If you’re wondering how to get a student loan, the best place to start for any soon-to-be college student is the Free Application for Federal Student Aid (FAFSA). Students must fill out the FAFSA form annually to be eligible for grant money, scholarships, and federal student loans. By completing the FAFSA, you’ll see what free money and federal loans you’re eligible for. Starting in Oct. 2018, the FAFSA will be available on a new phone app, making it even easier to fill out than ever before.

Choosing not to fill out the FAFSA is like saying “Nope,” to even the potential of free money or federal aid. The average FAFSA completion rate was about 61 percent for the class of 2018. Those students that make up the 39 percent who didn’t complete the FAFSA left billions of dollars of federal aid on the table.

What happens after I fill out the FAFSA?

When you complete the FAFSA, the information you entered will be reviewed. Your school should then generate a letter that will outline and explain all the options you have available to you. This can be the beginning and the end of the search for student loans for many. But sometimes the federal aid you’re eligible for won’t cover all the bills.

What if the federal aid I’m offered isn’t enough?

The process for applying for federal loans is pretty straightforward: send in your FAFSA and (hopefully) profit. But, applying for private loans is a far more variable process.

How do I apply for private student loans?

There are an estimated 5,525 commercial banks in the U.S. right now and each one of those institutions has their own rules and regulations when it comes to student loans. Most major banks and credit unions offer student loan options. You can even do an online search to find reputable private lenders who can help.

Generally, you’ll need to qualify for a loan with private lenders by having a solid credit score and a good debt-to-income ratio. If you’re not sure that you have those things (or if you’re sure you don’t), you may need help from a cosigner. Your cosigner could be a parent or guardian who has agreed to take on the responsibility of applying for these private loans with you. If you don’t have a cosigner, it may be more difficult to get approval for private student loans.

When applying for a private student loan, you should expect to:

- Provide proof of your identity

- Show proof of your financial health

- Sign a series of documents outlining the loan and its terms

- Get a cosigner for the loan if needed

If you’re approved for any private student loans, you’ll want to ask lots of questions about the terms of the loans. Working with small banks or credit unions can mean more one-on-one time for you with a loan servicer who can help you fully understand what to expect. If you’re applying for a loan with an online bank, make sure you make good use of any online chat features or give them a call.

How do I decide which loans are best?

You’ve got all your possible loans in front of you. Which one is going to be the best fit for you? The most important thing to keep in mind while you review these loans that you’ll have to pay them back. Make sure you understand what you’d likely have to pay each month and how much you’ll pay in interest over the life of your loan.

Federal vs. private

You’ll want a good understanding of the difference between federal student loans and private student loans. The general rule of thumb is to borrow as much as possible in federal student aid before turning to private loans. Federal student loans have better options for repayment, forgiveness, and deferment and forbearance. This means that you’ll want to seek federal student loans first.

Subsidized vs. unsubsidized

When it comes to federal student loans, you’ll also want to see if you qualify for subsidized or unsubsidized student loans. If you qualify for both, subsidized loans offer much better benefits than unsubsidized loans. So, if you’d like to have the government pay for the interest that accrues on your loans while you’re in school, go with subsidized before unsubsidized.

Other factors to consider

You’ll want to consider the interest rates on all the loans you’re eligible for. Higher interest rates mean that you will likely have to pay more back over the lifetime of the loan. Make sure that the loans you want offer repayment plans that will work with your post-college plans.

How do I accept the loans I want?

Once you’ve figured out how to get a student loan and you’ve considered your options, you will need to accept the loans you want.

Accepting federal student loans

For federal student loans, the process is easy. You should get a letter outlining all your federal aid options. When you do, you’ll work with your school to let them know which loans you want to accept. You’ll likely have to sign paperwork. You may also have to take a short online course about your loans. It’s possible you can complete both the paperwork and the course electronically.

Accepting private student loans

When it comes to private student loans, the process is easy too, but again, variable depending on the lender. You’ll likely have to sign lots of paperwork. You will work with the bank or credit union offering the loan to complete any necessary requirements.

Once you’ve compared your loans and accepted the best options for you, give yourself a pat on the back. You’ve successfully helped fund your college education. Now try to enjoy the next four years. But don’t forget to make sure you have a plan to pay back those loans!

Disclaimer: The viewpoints and information expressed are that of the author(s) and do not necessarily reflect the opinions, viewpoints and official policies of any financial institution and/or government agency. All situations are unique and additional information can be obtained by contacting your loan servicer or a student loan professional.