What Is Wage Garnishment? (Spoiler Alert: It’s Not Parsley)

Garnishment. The first thing that comes to mind when you hear that word might be a decorative sprig of parsley next to a fancy plate of porkchop. Or you may imagine a crisp stick of celery in a tasty Bloody Mary. Those types of garnishes are delightful and enhance your meal or drink. So, what is wage garnishment? Is it like adding some cilantro to your paycheck? Unfortunately, the truth is far less pleasant.

What is wage garnishment?

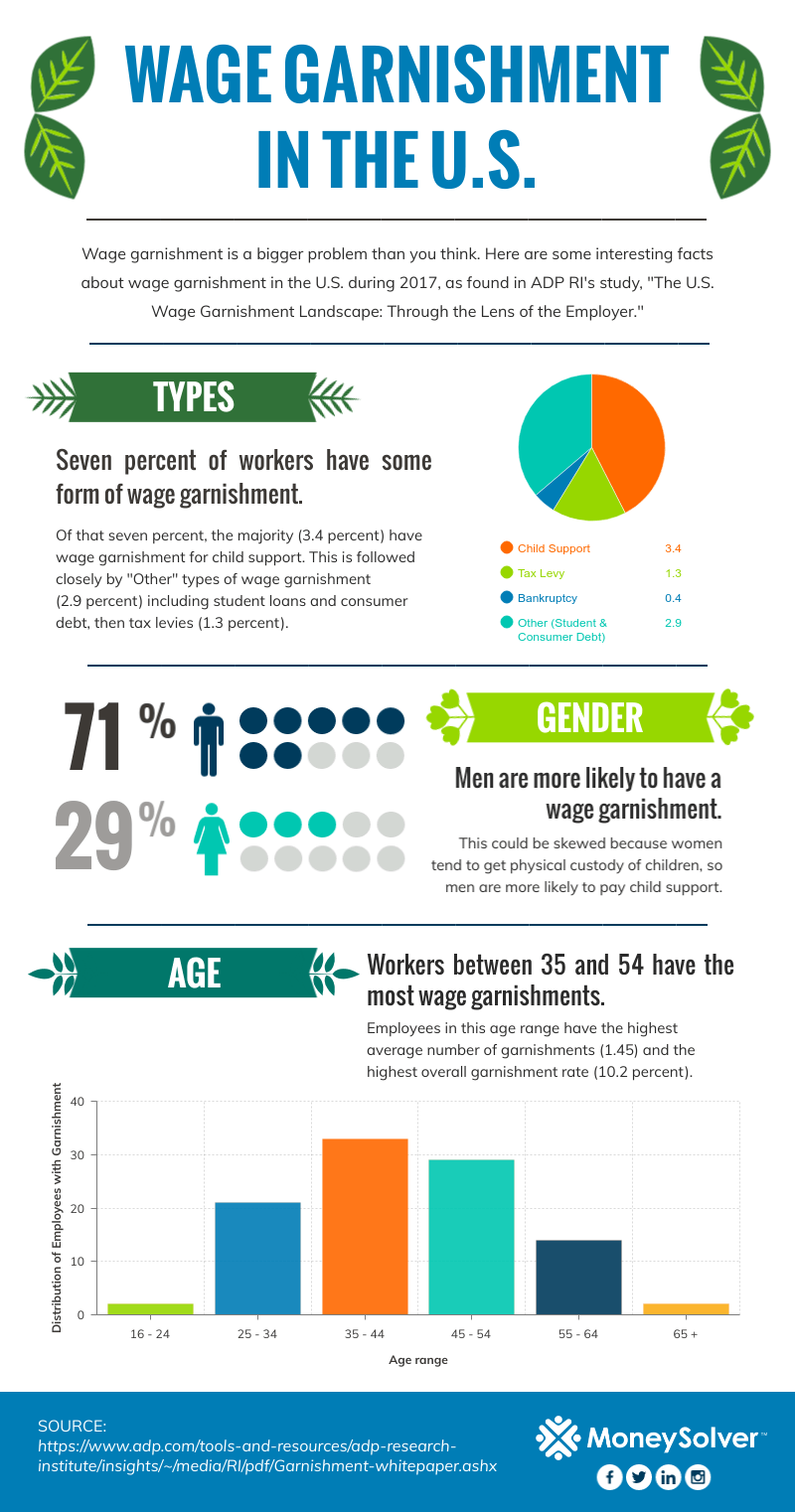

Wage garnishment is when your earnings are legally withheld by your employer to pay outstanding debt. A typical example of wage garnishment would be the IRS levying your wages in an attempt to repay your outstanding tax debt balance with them.

There are different reasons for wage garnishment outside tax debt. These include garnishment for student loan debt, child support, and consumer debt.

Wage garnishment isn’t a rare occurrence. In ADP RI’s 2016 study, one in 14 workers was found to be carrying a wage garnishment.

How wage garnishment starts

Wage garnishment starts when a creditor requires your employer to withhold a certain amount of money from your paycheck. Your employer then pays those withheld wages to the person or entity with whom you have a debt.

Some garnishments begin with a court order. But with federal student loans, back taxes, or child support, no court order is needed to begin garnishing your wages.

You should receive notice before the garnishment begins. For instance, the IRS will send you letters notifying you of their impending actions. These notices will often give you time to resolve the issue before the garnishment begins.

While garnishment is usually started once you’ve had outstanding debt and received notice, there was a recent proposal in the Senate to legalize mandatory wage garnishment for anyone with student loan debt. If that proposal passes, employers would automatically deduct payments from the paychecks of employees who have federal student loans.

The rights you have in the face of wage garnishment

While wage garnishment can leave you feeling helpless, you still have some important rights:

- You must receive legal notification about the garnishment.

- There is a limit to how much of your wages can be garnished in a week. This can vary depending on who is garnishing your wages, where you live, how many children you have, and whether you’re head of household. If your wages are being garnished by the IRS, they offer a helpful table for figuring out the amount exempt from their wage levies.

- You cannot be fired from employment because your wages are being garnished for any one debt. However, there is not necessarily protection from employment termination if your wages are being garnished for more than one debt.

- You can dispute your garnishment if you believe you don’t owe the debt. This may require a lengthy appeals process, especially if your wages are being garnished for tax debt.

How to stop garnishment – and get your life back on track

Now that you know what wage garnishment is and how it starts, you’re one step closer to putting a stop to it.

Wage garnishment typically does not stop until you pay the entire debt balance in full. For IRS back tax issues, this balance can include any interest, penalties, and collection fees accrued over the course of your debt.

If you do not have enough money to pay the debt in full, you can always talk to a professional about the other resolution options that exist for you. With IRS wage garnishment, a tax expert can help you figure out a solution like a payment plan that works for both you and the IRS. This sort of resolution will result in the IRS releasing your paycheck garnishment. No wage garnishment means you get back to living your life more comfortably.

*Read the original post on our Tax Defense Network blog