What is the IRS Debt Forgiveness Program?

Even the IRS understands life happens. That’s why the government offers IRS debt forgiveness when you can’t afford to pay your tax debt.

Under certain circumstances, taxpayers can have their tax debt partially forgiven. When the IRS considers forgiving your tax liability, they look at your present financial condition first. This means the IRS can’t collect more than you can reasonably pay. If any collection action would force you into a financial crisis where you lose all sense of financial security, the IRS can’t collect the back taxes.

Know What You Owe

Before applying for IRS programs, find out how much in taxes you owe to the IRS. Knowing where you currently stand with your tax debt is vital when it comes to asking for IRS forgiveness.

There are many different ways to find out how much you owe, including checking online through the IRS’s new portal, calling the IRS, mailing the IRS a form, and having a tax professional do the research for you. No matter how you figure out how much you owe in back taxes, you’ll need to know before seeking forgiveness.

Be on the Lookout for IRS Collection Actions

If you can’t pay but you haven’t reached out to the IRS for forgiveness or assistance, you should still expect them to begin taking collection actions against you. These actions can range from seemingly benign, like loads of notices in the mail, to very aggressive, like private debt collection agencies getting involved and tracking you down. You could also find that your passport is at risk due to tax debt.

Some of the IRS’s often-used collection actions include:

Tax lien

A tax lien is the government’s claim against your property, which will secure their interest in your assets if you fail to pay your tax debt. Unlike a levy, a lien doesn’t mean your property will be taken immediately. However, you’ll still need to address the lien. Not only can a lien keep you from selling your property, but it can also snowball into a more aggressive action in the future.

Tax levy

A tax levy is the government’s legal seizure of your property to satisfy your outstanding unpaid tax debt. You should receive a notice of levy from the IRS, which will let you know that they are planning to pursue levying actions against you.

Levies can be placed on personal property like your home, car, or boat. They can also be placed on your assets, like your bank funds, tax refunds, and wages.

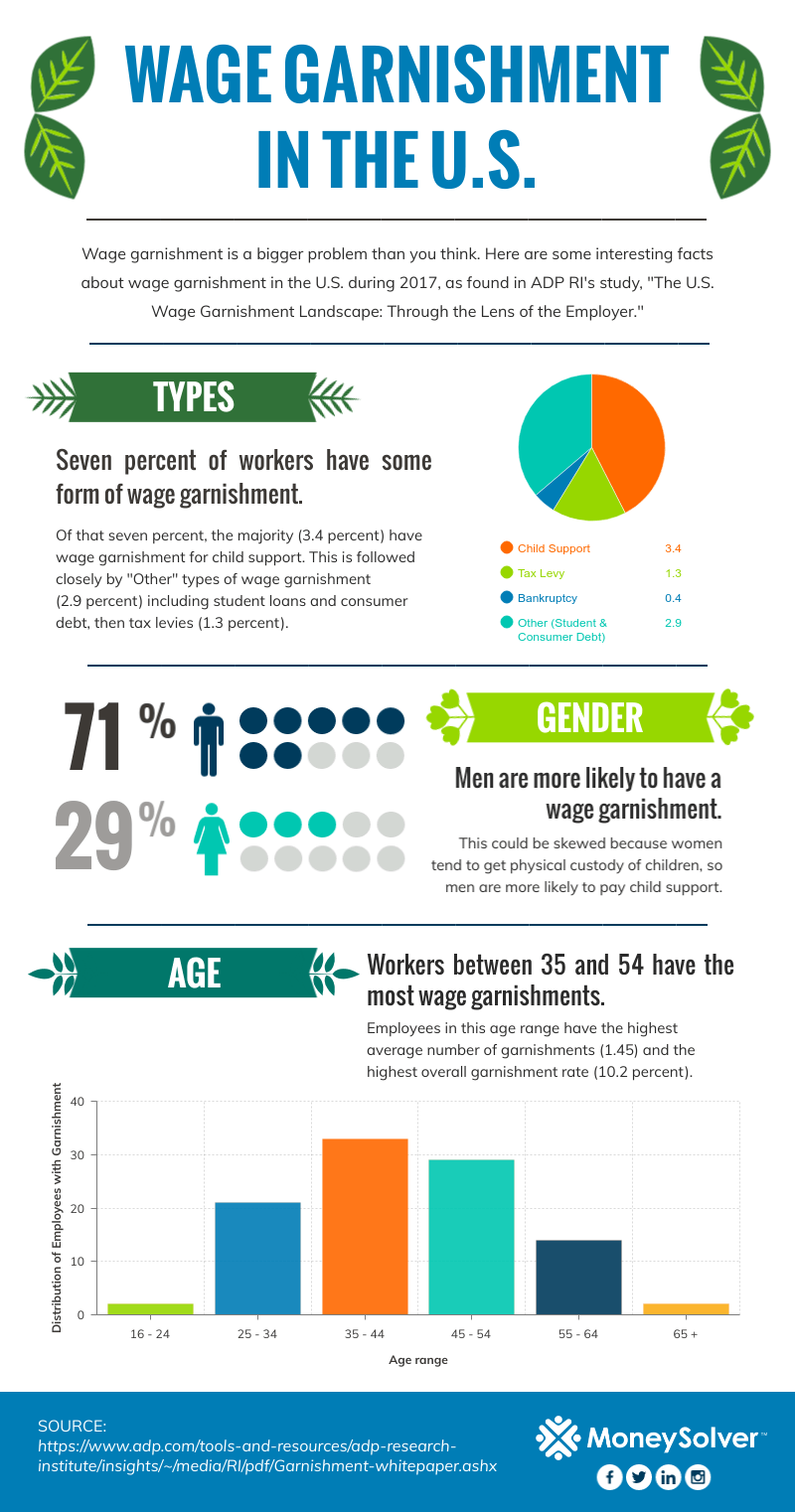

Wage garnishment

Wage garnishment is a type of tax levy in which the IRS will take part of your income in order to settle your existing tax debt. They will do this through your employer and will continue garnishing your wages until your tax debt is paid or other arrangements are made to pay your tax debt.

For more information about wage garnishment, check out this infographic:

If you find yourself facing these collection actions and they seriously threaten your financial security, tax debt forgiveness could be what you need.

Pay Less Than You Owe with Offer in Compromise

If you have the resources to pay a partial amount of your IRS tax debt, there’s still hope. You can apply for the IRS government payment plan called an Offer in Compromise (OIC) to resolve the remaining amount. Depending on your financial capacity and upon acceptance, the IRS significantly reduces the total debt that you can pay. This reduced amount can be paid in a lump sum or in fixed monthly payments.

There is a catch with the Offer in Compromise program though. It isn’t always easy to qualify for an OIC. The IRS considers your ability to pay, income, expenses, and asset equity when determining your eligibility for an OIC. While it can be a life-changing tax resolution for many people, the IRS doesn’t give an Offer in Compromise easily.

Here are some common reasons for ineligibility:

- You haven’t filed all required tax returns

- You haven’t made any required estimated tax payments

- You’re currently in an open bankruptcy proceeding

- You own a business with employees and haven’t submitted all required tax deposits

- You could pay your tax debt in a lump sum or through an installment agreement and/or equity in assets

But don’t let any catches deter you from seeking back taxes help. If you’re concerned you may not qualify for an OIC, consult a tax professional to see what IRS forgiveness options might be available to you.

See If You Qualify for the IRS Fresh Start Initiative

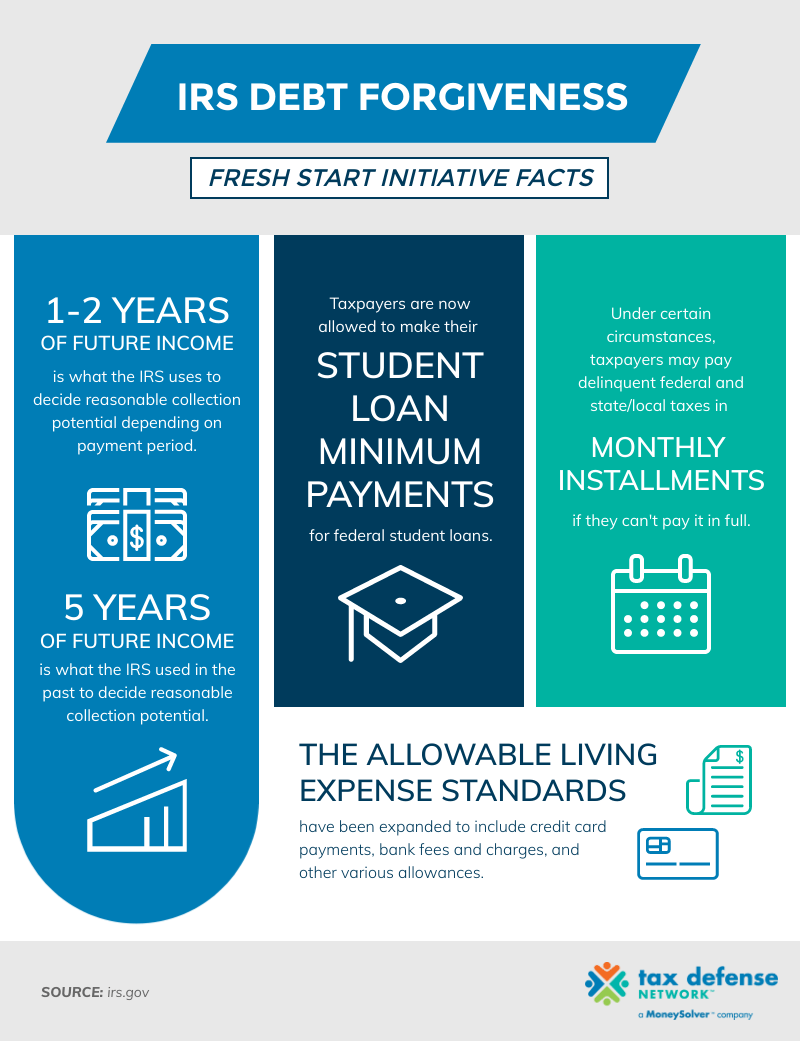

To make it easier for taxpayers to qualify for an OIC, the IRS has expanded its Fresh Start initiative.

These changes to the Fresh Start initiative make it easier to afford your IRS tax payments. Now, you won’t have to disclose extensive financial details to the IRS to judge your paying ability.

- Instead of looking at five years of future income to determine reasonable collection potential, the IRS now looks at only one to two years of future income for offers, depending on the payment period.

- Taxpayers are now allowed to make their student loan minimum payments for post-high school education loans guaranteed by the federal government.

- Taxpayers may, under certain conditions including financial hardship, pay delinquent federal and state or local taxes in monthly installments if they cannot pay it in full.

- The IRS has expanded the Allowable Living Expense standards. This allowance now includes credit card payments, bank fees and charges, and other various allowances.

- The IRS has doubled the dollar threshold for taxpayers eligible for Installment Agreements, which will help more people qualify.

What’s Next If You Owe Tax Debt?

Understanding your tax debt and dealing with the IRS isn’t easy to do alone, even with available programs like Fresh Start. Fortunately, there are professionals who can help you navigate your options. In fact, professional help may be necessary for you to get the best outcome for your tax problems.

Tax Defense Network’s team of trained tax professionals has been helping people with IRS issues since 2007. It all starts with a free consultation to get you on your way to a better tax solution.

*Read the original post on our Tax Defense Network blog