The Student Debt Relief Plan: Your Questions Answered

Last week, the Biden administration announced that it’s canceling up to $20,000 in student loan debt for millions of Americans. For most, this is welcome news, as many borrowers continue to struggle financially. Up to 43 million borrowers are expected to qualify for relief under the new plan. But, like most student loan recipients, many have questions about who is eligible, which loans qualify, and how to request relief. To better help you understand how the student debt relief plan with unfold, we’ve put together a list and provided the answers to the most frequently asked questions.

Student Loan Repayment Pause

Since President Biden took office, federal student loan borrowers have not been required to make any payments on their loans. The repayment pause was set to expire on August 31, 2022, but that is now extended through December 31, 2022.

Although the repayment pause has been extended several times, the Biden administration made it clear that this will be the final deadline. Payments for student loans will resume on January 1, 2023.

Do I need to do anything to ensure my payments remain paused throughout the remainder of the year?

No. The extension is automatic. You should receive a notification from your student loan servicer that your payments are paused until December 31, 2022.

Student Loan Cancelation

The repayment extension also gives the Department of Education (DOE) time to implement the student loan cancelation plan and identify those who are eligible to receive it. Here’s what you need to know.

Who is eligible?

The student debt relief plan provides help to lower- and middle-income families with federal student loan debt. You are eligible to receive relief if your adjusted gross income is less than $125,000 as an individual or no more than $250,000 per household (based on your 2020 or 2021 tax return). Those with private student loans do not qualify for cancelation. Federal student loans received after June 30, 2022, are also ineligible for relief.

How much of my debt will be forgiven?

If you are a Pell Grant recipient, up to $20,000 of your outstanding grant debt will be canceled. For all other federal student aid, up to $10,000 will be canceled. For example, the entire balance is forgiven if you have $8,500 in Direct Loans.

Do I get a refund if my loan amount is less than the total allowed?

No. You may only receive forgiveness on the balance of your federal loans, up to the total allowed. If that balance is lower than the limit allowed, no refund is provided.

I already paid off my loans. Can I get a refund?

Maybe. If you made any payments since March 13, 2020, you should reach out to your student loan servicer and request a refund of those payments. Loans paid off before that date, or payments made prior to the repayment freeze, are not eligible for a refund. Just be sure that any refund request does not exceed the total allowed under the student debt relief plan.

Are Parent PLUS loans eligible?

Yes! Most federal student loans qualify for cancelation, including Pell Grants, government-owned FFEL loans, and Direct Loans. This includes Parent PLUS and Grad PLUS loans, too. Some federal Perkins loans, however, may be excluded.

Am I eligible for loan debt forgiveness if I’m still in college?

Yes! As long as you have student loan debt from a federal loan received before June 30, 2022, you are eligible for forgiveness. If you’re listed as a dependent on your parent’s return, however, their income will be used to determine eligibility for forgiveness. Incoming freshmen whose loans were disbursed after June 30 are ineligible.

How do I request forgiveness of my loans?

As many as 8 million borrowers may receive automatic forgiveness because the DOE already has their income data on file. If you’re not included in this group, you’ll need to complete the online application which should be available in early October. To receive a notification when the application opens, sign up for federal student loan borrower updates on the DOE website.

The DOE encourages borrowers to file before November 15, 2022, to ensure the relief payment is applied to their account before student loan repayment resumes. The department will continue to process applications as they are received, even after the payment pause expires.

How long will it take to get relief?

After you complete the online application, you should receive relief in 4-6 weeks.

Do I have to pay taxes on the amount forgiven?

Maybe. Although you won’t owe any federal taxes on the amount forgiven thanks to the 2021 American Rescue Plan, you may have to pay state income taxes. Most states are expected to follow the IRS guidelines on this program but some may choose to tax the amount canceled. It’s best to consult with a tax professional to ensure you don’t get an unexpected bill when you file your return.

Potential Changes For Current & Future Borrowers

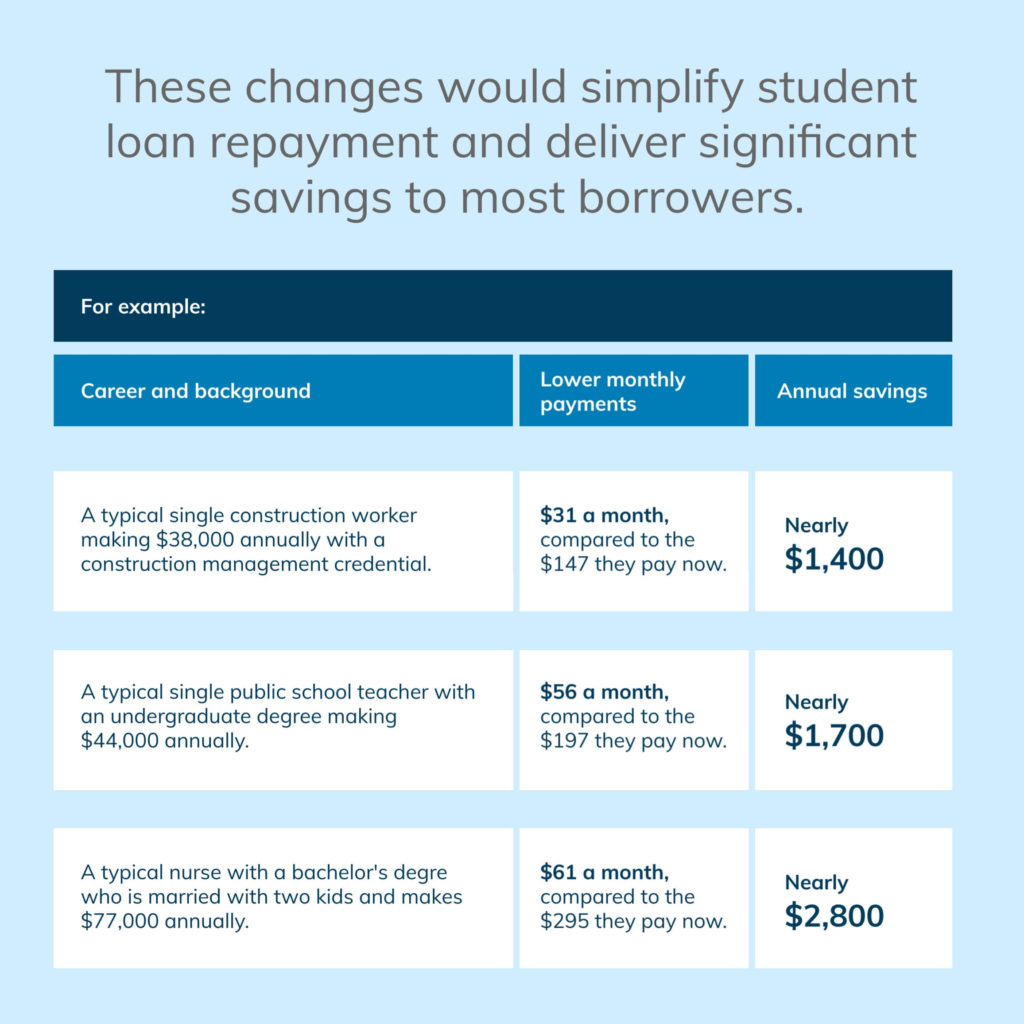

In addition to student loan debt cancelation, the Biden administration is working with the DOE to reform income-driven repayment plans for both current and future borrowers. The DOE is proposing to:

- Cut the income percentage from 10% to 5% for undergraduate loans. This will reduce monthly payments and make them more manageable.

- Increase the amount of income considered non-discretionary. This would guarantee borrowers earning less than 225% of the federal poverty level would have zero monthly payments.

- Offer loan forgiveness on balances after 10 years of payments. Currently, borrowers with original loan balances of $12,000 or less must make payments for 20 years to qualify. This change will allow nearly all community college borrowers to be debt-free within 10 years.

- Cover borrowers’ unpaid monthly interest. If enacted, loan balances would not increase as long as monthly payments are made, even if the borrower has a payment of $0 each month.

Additionally, the DOE has announced new actions to combat the mounting student debt crisis. This includes an annual watch list of programs with the worst student loan debt levels, as well as holding career colleges accountable when leaving their students with mountains of debt they can’t repay. The DOE has also re-established the enforcement unit in the Office of Federal Student Aid which oversees accreditors to ensure for-profit scandals become the exception and not the norm.

For updates and progress on the student debt relief plan, visit https://studentaid.gov/debt-relief-announcement/.