How to Create a Monthly Budget

Did you know that the average American has around $155,000 in debt? If you’re struggling with debt, it may be time to create a monthly budget. A budget can help curb your spending and ensure you are not living beyond your means. It not only takes into account your current financial outlook but also helps you plan for the future. Whether that’s putting away money for a house or new vehicle, or looking ahead to retirement, creating a monthly budget will help you keep your eyes on the prize.

Why Create a Monthly Budget?

Building out a monthly budget has many advantages. It can help you prepare for unexpected emergencies, such as long-term illness or temporary job loss. Additionally, it can highlight bad spending habits and help you fine-tune your financial goals. When you know what’s coming in and where your money is going, it’s also easier to take control of your spending and stay out of debt.

What’s The 50/30/20 Rule?

One of the most common ways to create a monthly budget is to use the 50/30/20 rule. U.S. Senator Elizabeth Warren first highlighted this method in her 2005 book, “All Your Worth: The Ultimate Lifetime Money Plan.” Basically, you divide your monthly net income into three categories: 50% for needs, 30% for wants, and 20% for savings or paying off debt.

50% For Needs

This category should only include costs for things you absolutely need to survive and must pay every month. This generally includes:

- Rent or mortgage

- Food (groceries)

- Utilities

- Insurance (medical, home, or pets)

- Transportation costs (gas, auto loan, etc.)

- Loans and credit card payments

If your expenses add up to more than half of your take-home pay, you’ll need to make some adjustments. For example, finding a different insurance carrier, reducing your grocery bill, or moving to a cheaper apartment.

30% For Wants

In this section, you’ll want to list your non-essential monthly expenses. These are things that make your life better but you could live without them if needed. This can vary from person to person, but typically includes:

- Entertainment & dining out

- Monthly memberships (gym, Amazon Prime, beauty boxes, etc.)

- App Subscriptions (Netflix, Hulu, Spotify, etc.)

- Clothing (excluding uniforms or other items required for employment)

- Travel (airfare, cruises, vacation rentals, etc.)

- Gifts

Once you crunch the numbers, you’re likely to find that you are spending more than you anticipated in this area. If it exceeds the allotted 30%, it’s time to trim some fat. Consider letting go of one or more of your app subscriptions or eating out less often.

20% for Savings

It’s important to pay yourself each month by setting aside 20% of your net income for savings and to help pay down debt faster. Although your minimum monthly payment for credit cards and loans should be listed in the “need” section, additional payments towards these balances will go into the “savings’ bucket. Keep in mind that you should refrain from taking on any unnecessary debt moving forward if you want your budget to succeed.

By setting aside 20% each month, you’ll quickly build your savings. This can be used for unexpected emergencies, retirement, and other financial goals – like a down payment on a new house!

How to Create a Monthly Budget With Google Sheets

An easy way to get a good look at your financial well-being is to create a monthly budget using Google Sheets. There’s a simple budget template available online that you can customize for your own needs or you can create one from scratch.

To use the template as-is, follow these three steps:

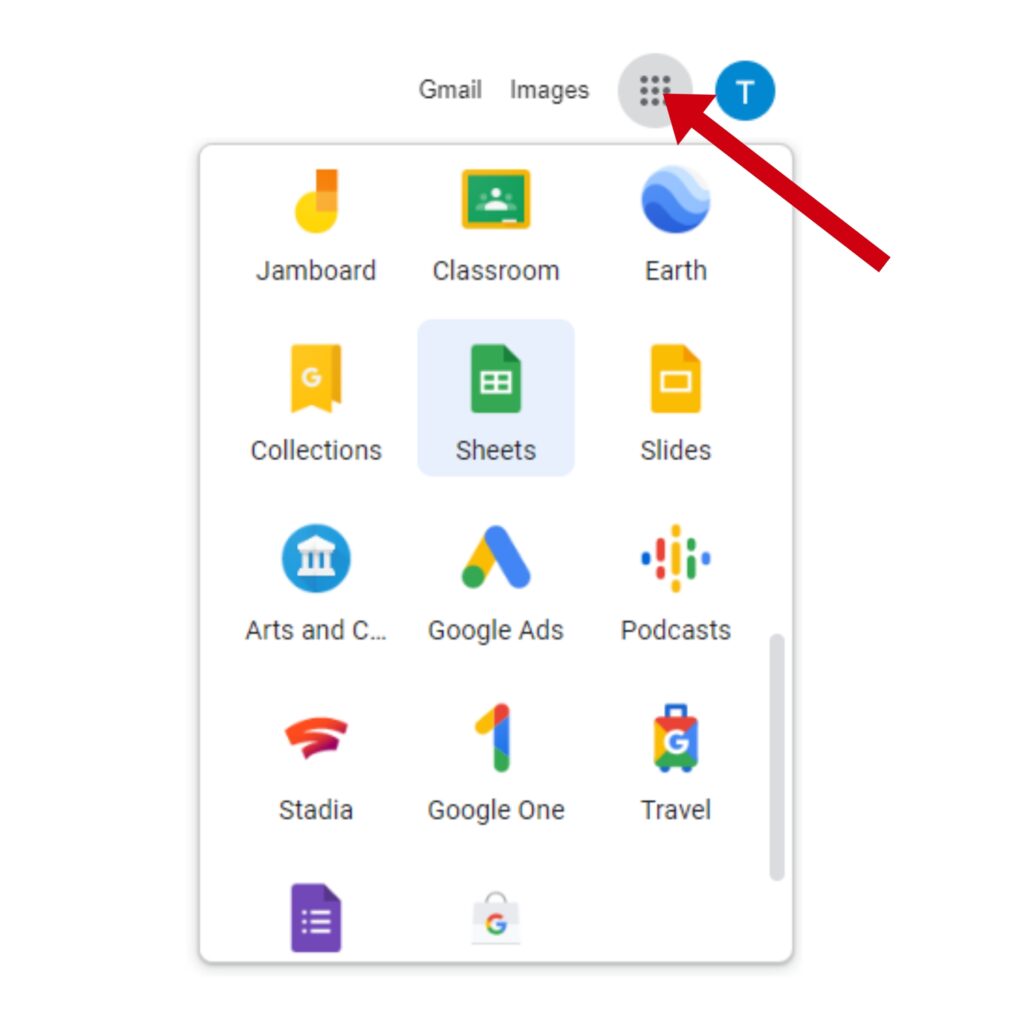

- Log into your Gmail account and open Google Sheets.

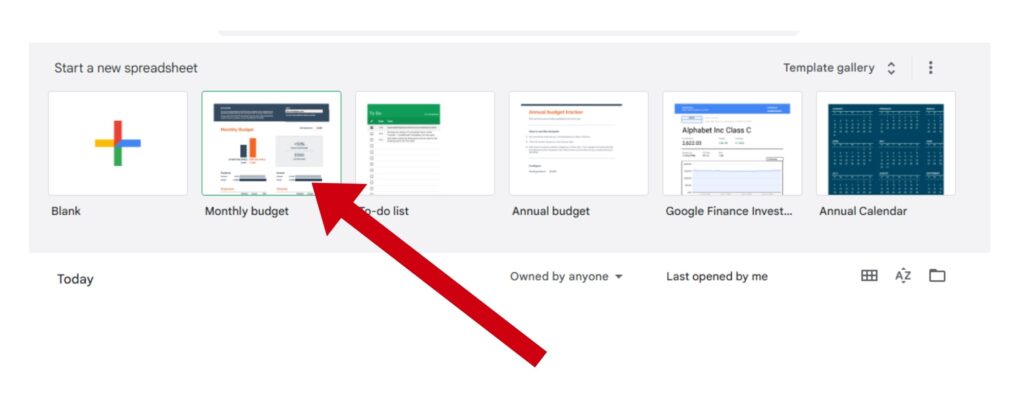

2. Open the Google Sheets Monthly Budget template.

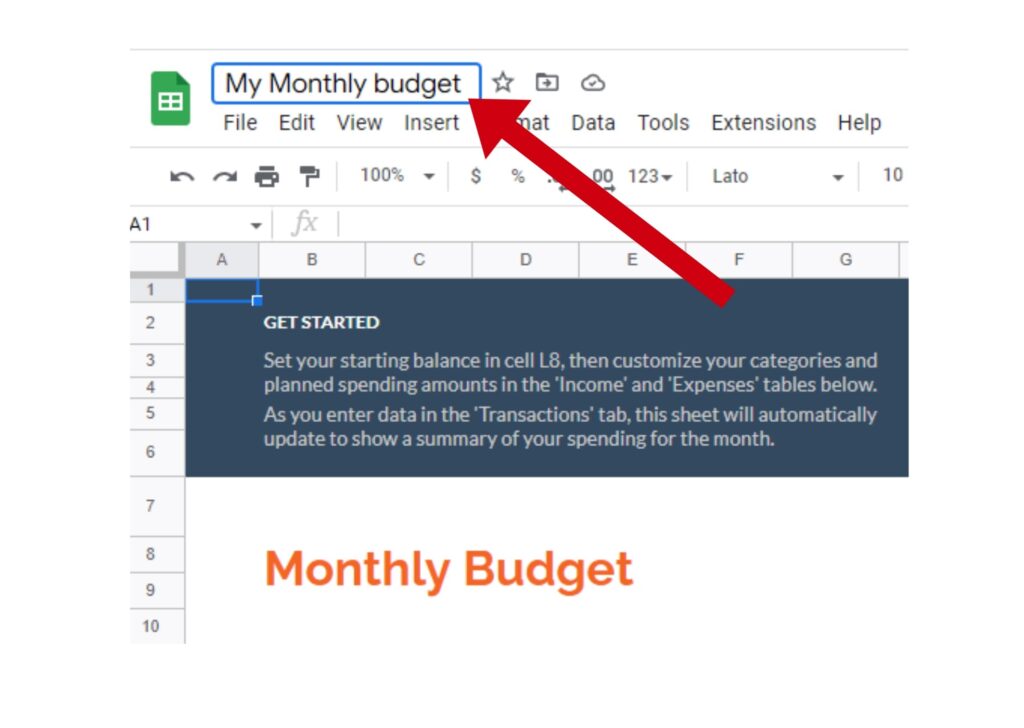

3. Name your spreadsheet.

If you want to customize the template, Michael Timmermann has an easy-to-follow video tutorial, as well as step-by-step instructions. You can also create a Google Sheets budget from scratch in less than an hour by following these simple instructions from Tiller.

Tips For Sticking to a Budget

The 50/30/20 rule is an example of a percentage-based budget strategy and is fairly easy to put into practice. There aren’t any strict rules, so feel free to adjust the percentages to fit your short- or long-term financial goals. You should also follow these tips for sticking to your monthly budget:

- Set realistic goals. If you want to succeed, start with baby steps and set realistic goals. For example, try weekly or monthly saving challenges instead of a year-long buying freeze.

- Plan your meals. An easy way to stick to your budget is to create a weekly menu and shopping list. By planning ahead, you’re less likely to overspend.

- Grocery shop online. Going to the store on an empty stomach is not a good idea. Temptation lurks around every corner! Resist the urge to buy unnecessary items by sticking to your list and shopping online.

- Pay yourself first. The only way to ensure your savings continues to grow is to pay yourself before paying others. Set aside a few dollars each paycheck and it will begin to add up over time.

- Wait 24 hours before making a big purchase. Weigh the pros and cons of the purchase, and ask yourself, “Is this a want or a need?” By taking some time to mull it over, you’ll not only avoid buyer’s remorse but also keep your budget in check.

- Ditch your credit cards! Credit cards make it all too easy to live beyond your means and can create a vicious cycle of debt. If you want to stick to your budget, only use cash or your debit card.

Don’t forget to treat yourself when you hit your budgeting goals. If you keep it fun, budgeting will feel less like a chore or more like a game.

Monthly Budgeting Resources

There are numerous online resources to help you create and achieve your budgeting goals. Here are just a few we suggest checking out.

- Mint. Considered one of the best free budgeting apps, Mint is available for both Apple and Android users. It links to your bank accounts and credit cards. You can even set customized spending alerts and bill reminders.

- Goodbudget. If you’re interested in trying the “envelope method” of budgeting, this free phone app is a good place to start! It gives you 1 free account with up to 10 envelopes. You can also upgrade to unlimited accounts and envelopes for only $8 per month.

- Home Budget Calculator. This free tool from Bankrate.com can help you see where your money is going and identify areas for improvement.

- Microsoft 365 Budget Template. Download this template and take control of your monthly budget. Just fill in the cells to monitor your spending habits.

- Rocket Money. This app can help you create a budget and it will analyze your transactions. You can set goals and set alerts. Additional features include subscription management, bill negotiation, and savings autopilot.

- YNAB. For those who prefer to use a zero-based budgeting system, YNAB (You Need a Budget) is the perfect choice. It’s $14.99 a month or $99 annually (if paid in full). You can use it on your phone, computer, tablet, Apple Watch, and Alexa.