How Do I File a Tax Extension Before the Deadline?

It’s not just you; it really does feel like the first few months of 2019 have flown by. We’re finding it hard to believe the federal tax deadline is next week! If you’re in the same boat and don’t know how you’re going to get your taxes filed in time, there’s no need to stress. A simple tax extension can give you the time you need. And rest assured, lots of people will need one this year. In fact, a record 14.6 million requests for filing extensions are expected this tax season. So, if you’re not sure how to file a tax extension, here’s our guide to getting that extension submitted on time.

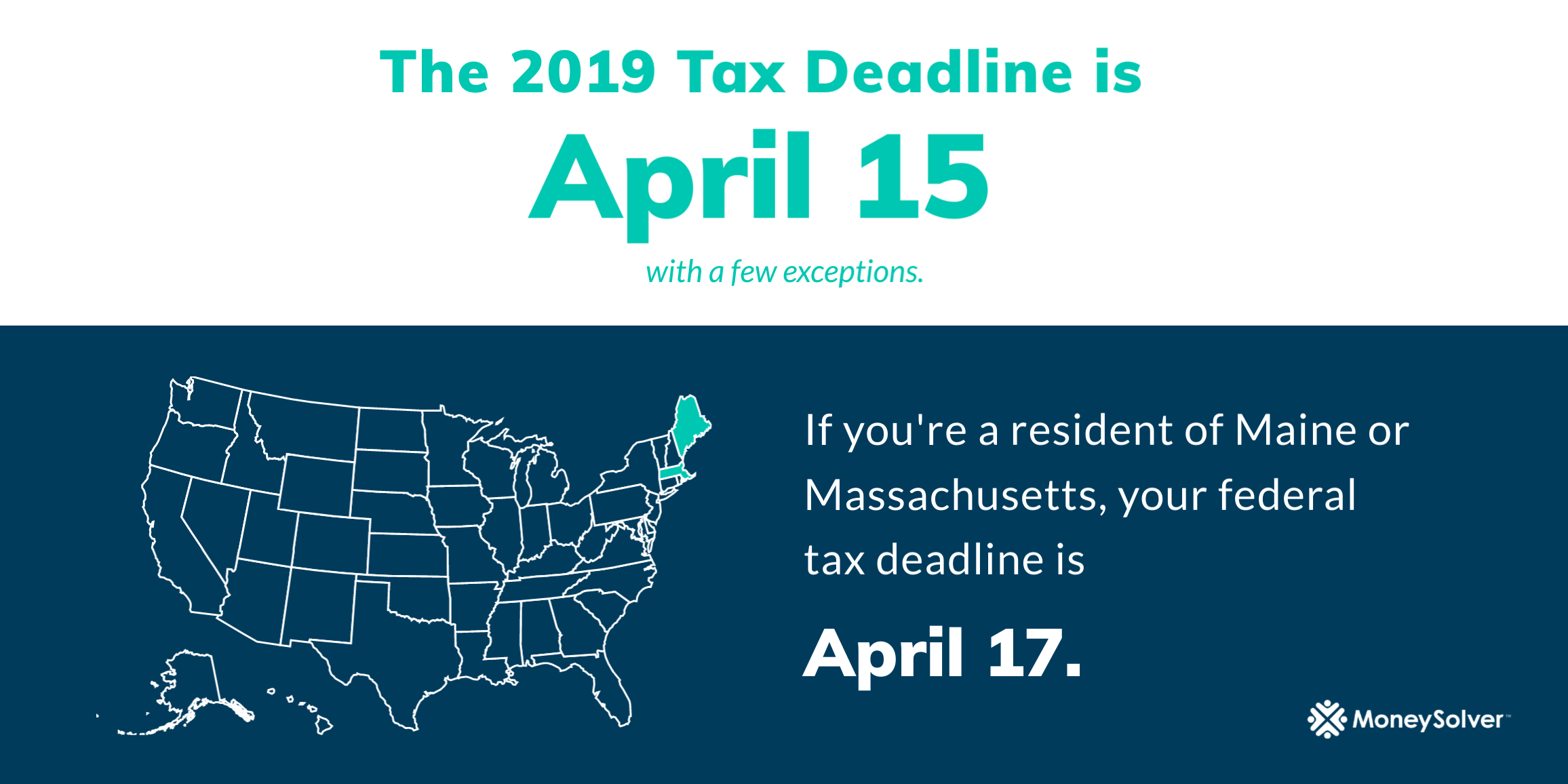

When Is the Tax Deadline Again?

Unless you live in Maine or Massachusetts, you have until April 15, 2019, to file your federal tax returns. If you are a resident of Maine or Massachusetts, you’ve got until April 17 to file thanks to two legal holidays.

What Happens If I Don’t File a Tax Extension?

If you don’t file your tax return by the due date (or by the extended due date if you had an approved extension), you face the wrath of the IRS in the form of the failure-to-file penalty. This is a five percent per month penalty on any unpaid tax balance you have. This penalty is charged each month (or even part of a month) that the return is late, for up to five months. Even if you file your return less than 30 days late, the failure-to-file penalty will apply for the whole month.

Didn’t file your extension on time and owe taxes? You can also receive a failure-to-pay penalty along with your failure-to-file penalty. If you have both these penalties running simultaneously, the IRS limits their combination to 5 percent overall. But let’s be honest: no one wants two IRS penalties at the same time.

Some people are afraid to file an extension because they think it could trigger an audit. However, the IRS encourages taxpayers to file for an extension if needed to help reduce tax-filing errors.

OK, but How Do I File a Tax Extension?

You can file for a six-month tax extension using Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. The IRS will review and hopefully approve your extension. Once you’ve gotten that approval, you’ll have until Oct. 15, 2019, to file your federal tax return.

You can either fill this form out and mail it to the IRS or you can submit it using a Free File software company. Some of these companies will also help you estimate what you’ll owe the IRS, so you can pay on time.

Whichever way you choose to submit Form 4868, make sure you do so by the due date of your return.

Remember: An extension to file is not an extension to pay.

Just because you have an extension on filing your taxes doesn’t mean you’ll have an extension on paying any taxes you owe this year.

What does this mean for you? If you don’t pay the taxes you owe by the April deadline, you stand to face the interest charged on any unpaid tax balance. The IRS might also hit you with an underpayment penalty or a failure-to-pay penalty on any overdue taxes. However, some taxpayers may have a break from these penalties because of the recent tax reform. The Treasury Department has stated that they will allow taxpayers who paid at least 80 percent of their tax bill during the year to avoid paying penalties.

Also, if you’ve gotten an extension and you pay at least 80 percent of your actual tax liability by the actual April tax deadline, you can avoid a failure-to-pay penalty. How? You’ll need to make sure you pay the remaining balance by your extended due date of Oct. 15.

Even if you do owe, filing your extension will at least help you dodge a failure-to-file penalty. And since the failure-to-file penalty is usually higher than the failure-to-pay penalty, you’ll be dodging a much more financially-burdening bullet.

Will I Still Get My Tax Refund?

Unfortunately, no tax return = no refund. You won’t get your refund until you file your return. The IRS must process your return before determining if you’re due a refund.

Don’t let the confusing tax law changes cause you to incur a failure-to-file penalty. Especially if you’re a business owner, you’ll want to make sure you’re taking the time to make the most of your taxes. The best way to get some extra time is by filing an extension today.

Need help filing your return and maximizing your deductions? Our tax professionals are ready to help.

*Read the original post on our Tax Defense Network blog